Updates

On March 26, 2021, Guinness Atkinson Asia Pacific Dividend Builder Fund (GAADX) and the Guinness Atkinson Dividend Builder Fund (GAINX) were converted into ETFs.

Following the model pioneered by GA, Adaptive Fundamental Growth Fund, Adaptive Hedged High Income Fund, Adaptive Hedged Multi-Asset Income Fund, Adaptive Tactical Outlook Fund, and Adaptive Tactical Rotation Fund are being converted into the Adaptive Fundamental Growth ETF, Adaptive Hedged High Income ETF, Adaptive Hedged Multi-Asset Income ETF, Adaptive Tactical Outlook ETF, and Adaptive Tactical Rotation ETF, respectively.

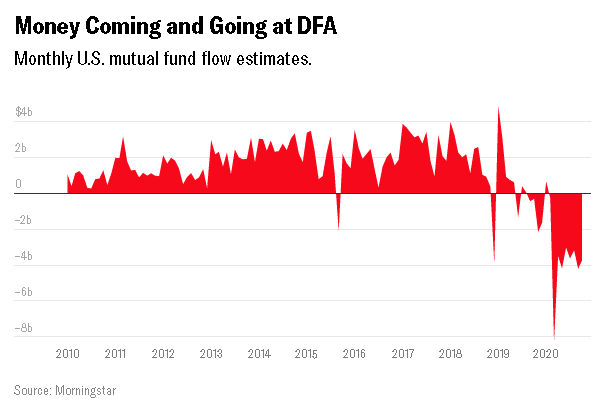

DFA, the other firm that has committed to transforming funds into active ETFs, reports that their first active ETFs, launched in November 2020, now have over $1 billion in assets. Their plans call for converting $26 billion in existing funds into active ETFs (Investment News, 3/4/2021). The hope, according to RIA Intel (11/17/2020) is to stanch the $3 billion per month outflows that the firm has been seeing.

Briefly Noted . . .

Arrow Reverse Cap 500 ETF (YPS) has launched. It’s a passive fund in which the smallest company in the S&P 5000 Index will have the largest weight and the largest company in the Index will have the smallest weight. Previously it was known as the Reverse Cap Weighted US Large Cap ETF (RVRS) and earned a four-star rating as a mid-cap value fund. Described as “a contrarian play on the S&P 500,” the fund’s three smallest holdings are Apple, Facebook, and Microsoft. Its three largest are HollyFrontier (an oil company), Marathon (an oil company), and Gap (of The Gap, Old Navy, and Banana Republic fame).

Effective on or about May 26, 2021, the Catalyst/Lyons Tactical Allocation Fund’s investment objective will change from “total return from long-term capital appreciation and current income” to the more aggressive “long-term capital appreciation.” It’s small but has a four-star rating at Morningstar.

On March 9, 2021, Richard Driehaus died at Northwestern Memorial Hospital after having suffered a brain hemorrhage. Mr. Driehaus was the founder of Driehaus Capital Management and a major philanthropist in Chicago. He founded Driehaus Capital in 1982, and the Richard H. Driehaus Foundation in 1983 which seems like a highly principled move for a startup in its first year of operation. He was a momentum investor who eventually endowed a Center for Behavioral Finance at DePaul University, his alma mater. His family’s name is attached, Pensions & Investments reports, to “a museum, a foundation, an architecture prize, a fashion competition, numerous academic buildings and programs, and on awards celebrating historic preservation and the Chicago bungalow.” The main hall of the Driehaus Museum, dedicated to art and architecture, is pictured above.

Litman Gregory Asset Management, the parent company of Litman Gregory Fund Advisors which is the advisor to what are now called the PartnerSelect (formerly LitmanGregory Masters) Funds, has agreed to be acquired by iM Global Partner US, a French asset management company. The handover is expected to be completed in the second quarter of 2021 but is not expected to result in any material change in the day-to-day management of the funds.

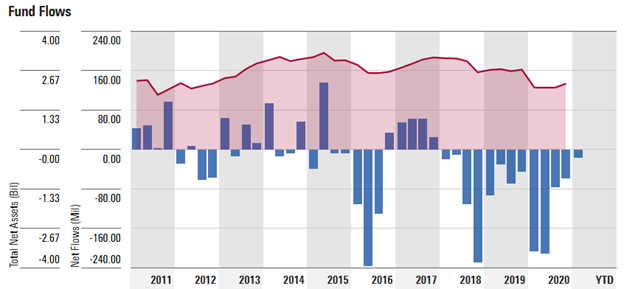

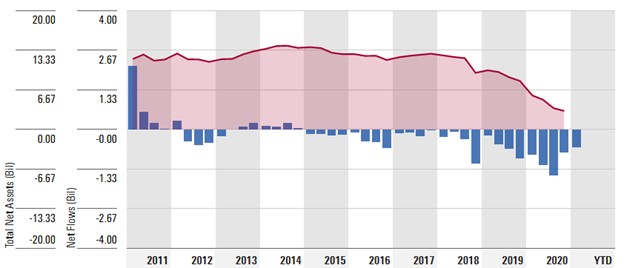

The sale is a tale of two lines.

The top line reflects LitmanGregory’s slowly declining assets even during a bull market and the blue lines reflect investor withdraws each quarter.

SMALL WINS FOR INVESTORS

Pioneer Securitized Income Fund will convert from a closed-end interval fund to an open-end fund sometime in the third quarter of 2021. Of all the sorts of conversions we cover, from hedge fund to mutual fund or mutual fund to ETFs, CEF to OEF has been the rarest sort. The fund only launched in December 2019 and has gathered only $17 million in assets which seems to be the fate of many interval funds: they represent an essential discipline for investing in illiquid securities but almost no one is interested in the prospect of not having daily liquidity.

CLOSINGS (and related inconveniences)

Calvert Emerging Markets Equity Fund will soft-close on May 14, 2021. It’s a four-star fund with $4.4 billion in assets. Substantially higher returns (9.9% vs 5.8%) and lower volatility (15.8% S.D. vs. 17.5%) since inception than its Lipper EM peers.

Hartford Schroders Emerging Markets Equity Fund will soft-close on April 15, 2021. Four-stars, $6 billion in AUM.

On March 12, 2021, JPMorgan Hedged Equity Fund instituted a softer-than-usual close with nine listed exceptions.

PIMCO California Municipal Opportunistic Value Fund and PIMCO National Municipal Opportunistic Value Fund were hard-closed on March 3, 2021.

PPM Small Cap Value Fund closed to new investors on March 13, 2021.

Wasatch Small Cap Value and Micro Cap (and their related institutional strategies) have closed to new investors attempting to set up accounts using third-party platforms such as Schwab or Fidelity. The funds remain open to investors working directly with Wasatch.

OLD WINE, NEW BOTTLES

Effective March 15, 2021, the Adaptive Hedged Income Fund is changing its name to Adaptive Hedged Multi-Asset Income Fund and the Adaptive Tactical Economic Fund is changing its name to the Adaptive Tactical Outlook Fund.

Effective April 23, 2021, Agility Shares Managed Risk ETF becomes Toews Agility Shares Managed Risk ETF while Agility Shares Dynamic Tactical Income ETF transforms into Toews Agility Shares Dynamic Tactical Income ETF.

In a rare development, DoubleLine has been booted from the management of AMG Managers DoubleLine Core Plus Bond Fund and replaced by Beutel, Goodman & Company Ltd. In connection with the hiring of Beutel Goodman, the fund changed its name to AMG Beutel Goodman Core Plus Bond.

Similarly, with the replacement of Freiss Associates with Boston Common Asset Management, AMG Managers Brandywine Fund becomes AMG Boston Common Global Impact Fund.

Finally, Loomis Sayles got removed from control of AMG Managers Loomis Sayles Bond Fund which led to the creation of AMG GW&K ESG Bond Fund.

Effective on or about June 9, 2021, Columbia Seligman Communications and Information Fund becomes Columbia Seligman Technology and Information Fund.

Strap in! On June 9, 2021, Columbia Small Cap Growth Fund I will change its name to Columbia Small Cap Growth Fund. In an equally bold move, Columbia Global Equity Value becomes Columbia Global Value which, so far as I can tell, will continue to invest in equities.

On March 5, 2021, perhaps in an attempt to sound a little bit less pathetic and grubby, the name DEMZ Political Contributions ETF will change to the Democratic Large Cap Core ETF.

Effective May 27, 2021, Federated Hermes Select Total Return Bond Fund will change its name to Federated Hermes Core Bond Fund.

As of April 1, 2021, the Global X funds are a bit less thematic and perhaps not quite so disruptive.

| Current name | Improved name! |

| Global X Health & Wellness Thematic ETF | Global X Health & Wellness ETF |

| Global X Longevity Thematic ETF (LNGR) | Global X Aging Population ETF (AGNG) |

| Global X Millennials Thematic ETF | Global X Millennial Consumer ETF |

| Global X China Disruption ETF | Global X China Innovation ETF |

Effective April 30, 2021, the name of the three-star Hartford Multi-Asset Income and Growth Fund will change to Hartford Multi-Asset Income Fund. The fund’s current yield is 2.96% from a portfolio that’s about 50% global fixed-income and 50% equities or equity-linked stuff.

Effective April 30, 2021, the name of Hartford Municipal Income Fund will change to Hartford Sustainable Municipal Bond Fund.

On March 19, 2021the iShares Morningstar Large-Cap Growth ETF (JKE) was rechristened the iShares Morningstar Growth ETF whereupon it made two complementary (?) moves: it became more diversified by adding mid-caps to its investment universe and less diversified by … well, declaring itself non-diversified. The current version of the fund is a mega-cap growth portfolio with $1.8 billion in assets and a four-star rating.

On July 21, 2021, JPMorgan Small Cap Core Fund becomes JPMorgan Small Cap Sustainable Leaders Fund. In addition, Robert Ippolito, Vice President, will be added as a portfolio manager of the Fund, replacing Jonathan Tse.

Effective May 1, 2021, MassMutual becomes rather less select. Each of 14 funds’ names will drop the word “Select” from the title. So, for example, MassMutual Select Total Return Bond Fund will change its name to MassMutual Total Return Bond Fund. Likewise, any MassMutual fund with “Premier” as part of the name, loses it: MassMutual Premier Core Bond Fund will change its name to MassMutual Core Bond Fund.

It’s back to the future! Effective April 30, 2021, the $51 million Monetta Core Growth Fund changes its name to the Monetta Young Investor Growth Fund (MYIFX) without changing manager, strategy, or fees. On August 28, 2018, Monetta Young Investor Fund changed its name to Monetta Core Growth Fund without changing manager, strategy, or fees. The fund name change followed two terrible years and an outrush of assets. The change back follows one relatively terrible year (up 20% but bottom 12% performance) and a steady but not huge outflow.

Monetta is a fund o’ household names. Don’t be fooled by the fund’s current two-star rating at Morningstar. It has handily outperformed its large-growth peers since inception, during the Global Financial Crisis, and over the full market cycle from 2007-2020. In addition, it’s averaged 17% of the past five years. Two drivers of its low star rating. It performed poorly in the Covid bear during Q1/2020 and it has been merely “solid” in a highly frothy market. In the three recent years when the fund badly trailed its peers, it posted total returns of 23%, (-5%) and 20%.

Monetta is a fund o’ household names. Don’t be fooled by the fund’s current two-star rating at Morningstar. It has handily outperformed its large-growth peers since inception, during the Global Financial Crisis, and over the full market cycle from 2007-2020. In addition, it’s averaged 17% of the past five years. Two drivers of its low star rating. It performed poorly in the Covid bear during Q1/2020 and it has been merely “solid” in a highly frothy market. In the three recent years when the fund badly trailed its peers, it posted total returns of 23%, (-5%) and 20%.

Effective April 30, 2021, the Muzinich U.S. High Yield Corporate Bond Fund will change its name to Muzinich U.S. High Yield Credit Fund. (They underlined the word “Credit” in the filing just in case you got lost in the course of reading a single declarative sentence.)

Effective March 31, 2021, Pax ESG Beta Dividend Fund became Pax Global Sustainable Infrastructure Fund and develops a curiosity about … oh, water treatment plants worldwide. On the same date, Pax MSCI EAFE ESG Leaders Index Fund becomes Pax International Sustainable Economy Fund. Also effective March 31, 2021, Pax High Yield Bond Fund is expected to be fossil fuel-free.

As of July 1, 2021, Schwab High Yield Municipal Bond Fund becomes Schwab Opportunistic Municipal Bond Fund. The fund promises to invest at least 80% in investment-grade bonds but to invest opportunistically, which might entail exposure to high yield bonds again.

Pending shareholder approval in late April, the Stadion funds become North Square funds.

| Acquired Fund | Acquiring Fund |

| Stadion Tactical Defensive Fund | North Square Tactical Defensive Fund |

| Stadion Tactical Growth Fund | North Square Tactical Growth Fund |

| Stadion Trilogy Alternative Return Fund | North Square Trilogy Alternative Return Fund |

OFF TO THE DUSTBIN OF HISTORY

AAM/HIMCO Global Enhanced Dividend Fund has closed and will undergo (their choice of verbs, not mine) “termination, liquidation and dissolution” on or about May 5, 2021.

In a move first signaled by the funds’ closure in December 2020, CornerCap Large/Mid-Cap Value Fund and CornerCap Balanced were liquidated on March 15, 2021.

DGHM MicroCap Value Fund is expected to liquidate on or about April 26, 2021.

Bad news for anyone looking for 1.35X leverage on the long bonds: The Direxion Monthly 25+ Year Treasury Bull 1.35X Fund and the Direxion Monthly 25+ Year Treasury Bear 1.35X Fund will cease operations on April 27, 2021.

On an as-yet-undisclosed date, First Trust RiverFront Dynamic Asia Pacific ETF will be merged with First Trust RiverFront Dynamic Developed International ETF.

Forester Discovery Fund has closed and is in the process of liquidating, but the adviser hasn’t offered any guess about when the liquidation will be complete.

The five-star, $4 million Integrity Energized Dividend Fund will, The Shadow notes, be de-energized, drained, and powered-down on or about June 30, 2021. A five-star fund in Morningstar’s rating and a high-volatility laggard in Lipper/MFO’s system. The key is your choice of benchmark: Morningstar calls it an energy fund (“Energized” by an 81% stake in the sector) while MFO calls it an equity income fund (“Dividends” leading to a 4.65% yield). So a quick reminder: buyer, reader, manager beware!

IVA Worldwide Fund and IVA International Fund, successors to the legendary SocGen funds led by Jean-Marie Eviellard, and all of their linked separate accounts, will be liquidated on April 19, 2021, as IVA closes up shop. Collapsing economics (the last time they saw net inflows was Q4/2014) and, one should suppose, profound discouragement (senior partners began leaving a year ago and were never replaced) drove the decision.

Assets stand at $2.4 billion, down by two-thirds in a year. They were buying value in a growth bull, buying mid- and small-cap in a large-cap bull, holding cash as the froth relentlessly grew. The requiem might be: “They paid the ultimate price for doing all the right things at all the wrong times.”

John Hancock Alternative Risk Premia Fund has closed and will be gone by May 10, 2021.

Putnam PanAgora Managed Futures Strategy and Putnam PanAgora Market Neutral Fund will close on April 26, 2021, and will be liquidated by May 21, 2021. After looking like such an unbeatable strategy on paper, “managed futures” has been an absolute death zone for funds.

RiverBridge Eco Leaders Fund, a four-star, $14 million fund that earned the Great Owl designation, has closed and will merge into Riverbridge Growth Fund on April 30, 2021.

On or before April 27, 2010, the Russell U.S. Dynamic Equity Fund will be liquidated. Two weeks before that date, the manager’s advisory fee will be dropped to zero. Hmmm … the fund’s “A” shares historically have charged high fees; the managers haven’t invested their own money in the fund and Morningstar’s rating on the fund is “negative.” While I can understand the drop to zero, it’s hard to imagine it being praiseworthy.

Selective Opportunity Fund has accelerated its planned liquidation, from June 21, 2021, to April 12, 2021.

After considering the continuing very low-yield market environment for U.S. Treasury securities and the small size of the TIFF Short-Term Fund, its board authorized the fund’s liquidation on June 15, 2021.

At a Board meeting held on March 9, 2021, the fund’s Board of Directors approved the liquidation and dissolution of the T. Rowe Price Government Money Portfolio fund. The liquidation is expected to occur on May 6, 202

The $30 million Two Oaks Diversified Growth and Income Fund will merge with the $140 million North Star Opportunity Fund in May 7, 2021. Both are all-cap domestic equity funds with a willingness to hold some combination of bonds and cash; both sit about 75% equity / 25% other but North Star has a substantially stronger record. On whole, a win for the investors.

The liquidation of Wells Fargo Intrinsic World Equity Fund is expected to occur after the close of business on or about April 23, 2021. It’s seen complete manager turnover in the past decade but it’s, otherwise, a perfectly respectable $160 million fund. Quite possibly the fund wasn’t attractive to the private equity firms which recently bought Wells Asset Management.