Dear friends,

Chip and I escaped for a bit this month. We headed northeast to Door County, the peninsula that extends above Green Bay, Wisconsin. Like the Dingle Peninsula in Ireland, Door County represents “my happy place.” For folks unfamiliar with it, imagine a less commercialized version of Cape Cod: water on both sides, farms in between, cherries everywhere, no chain restaurants at all, and a series of small lakeside or bayside towns whose permanent populations number in the hundreds.

Here was the plan: disconnect from the outside world, and connect with each other.

It worked. We didn’t have a computer. Total TV time was zero. Our phones were dormant, except for checking restaurant hours. We started each day with ridiculously strong coffee and a snack, targeted one really good meal each day (lunch, which was cheaper and quieter than dinner), sensibly substituted dessert for our evening meal, and spent as much time in the woods and on the water as in shops or galleries. And then, sat happily in the really, really dark at Newport State Park, on the Lake Michigan side, which is one of only 48 internationally recognized Dark Sky Parks in the world.

The MFO homepage has a picture of me sitting on a dock in Ephraim, Wisconsin, at the site of the old Anderson’s General Store, which is now a gallery. Chip and I returned there this summer and, I must say, I like the look.

|

|

The Gallery on Anderson’s Dock, Ephraim Wisconsin, 2010 and 2022.

Regrets for the thousand bits of administrative stuff that I didn’t promptly pursue, from slow responses to your questions to late check deposits.

In the meantime, the guys have been working hard!

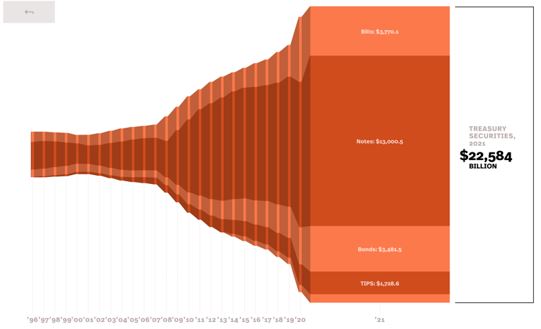

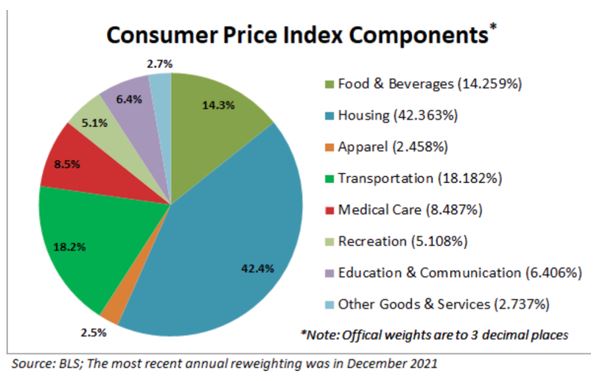

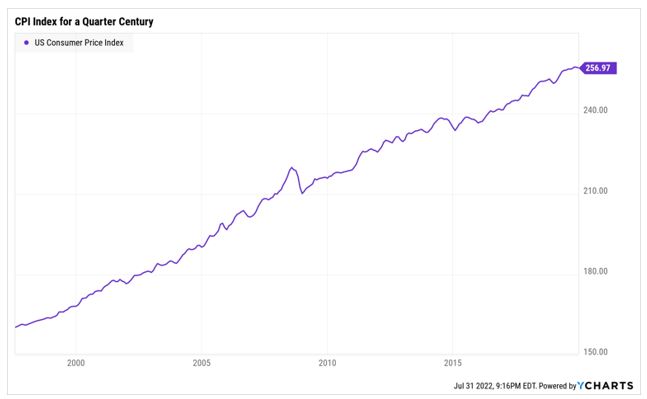

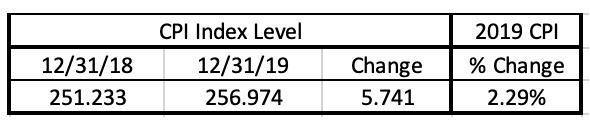

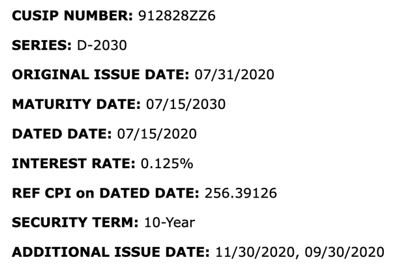

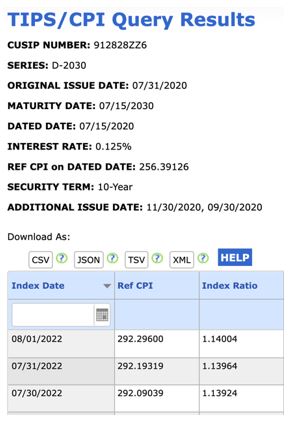

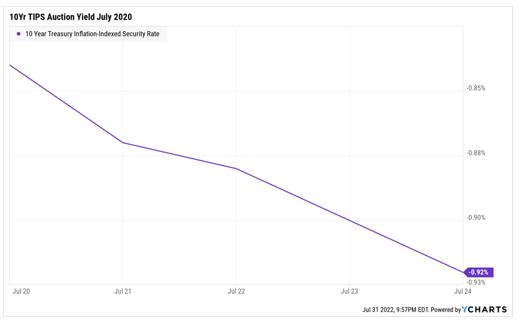

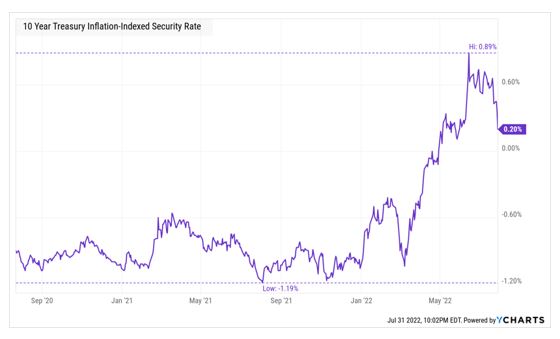

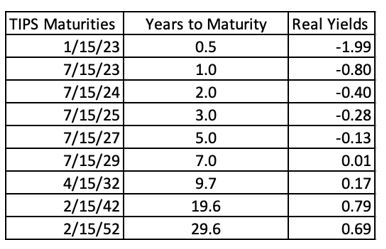

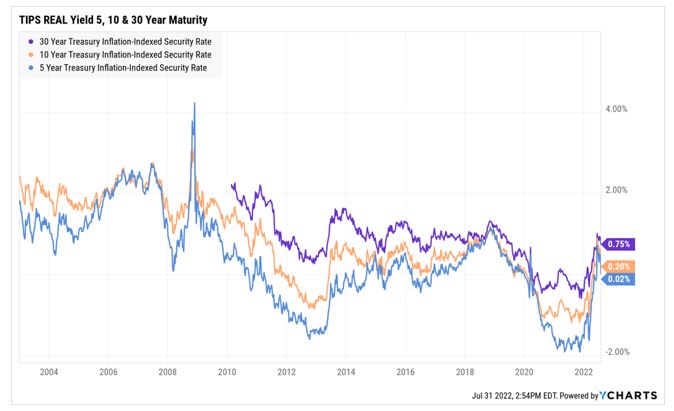

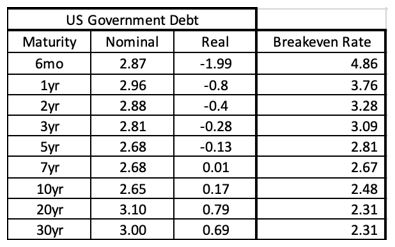

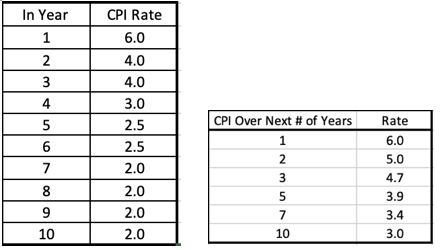

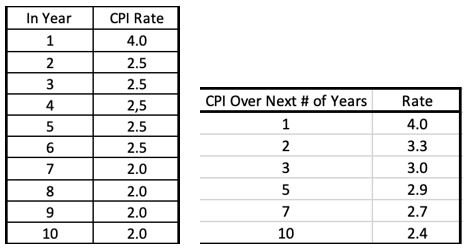

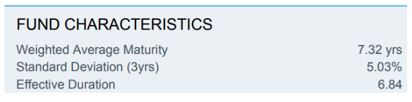

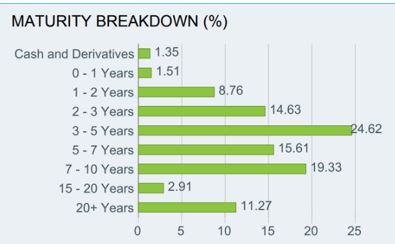

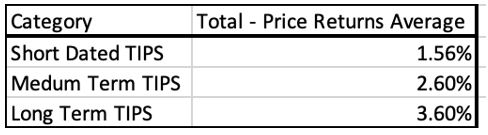

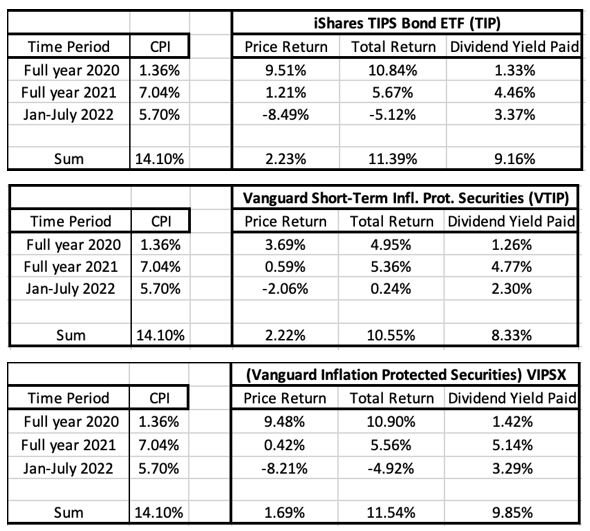

This month, Devesh gets serious about the abject and ongoing failure of TIPS. Really, they have only one job (“inflation protection” is right in the name), and they’re falling down at it. He works through why that’s the case and when it might be worth looking at them again.

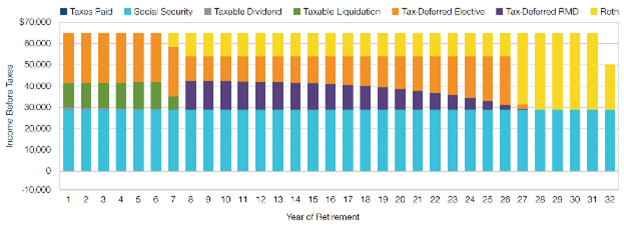

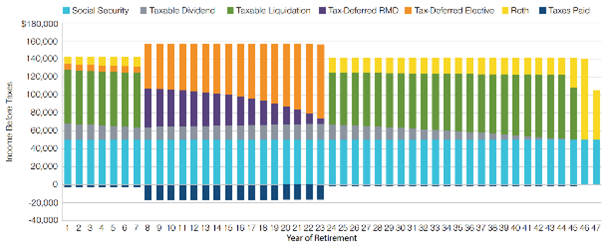

Lynn Bolin celebrates his second month of retirement (a lot) and uses it as an opportunity to walk through the decisions and challenges that investors face in making that transition.

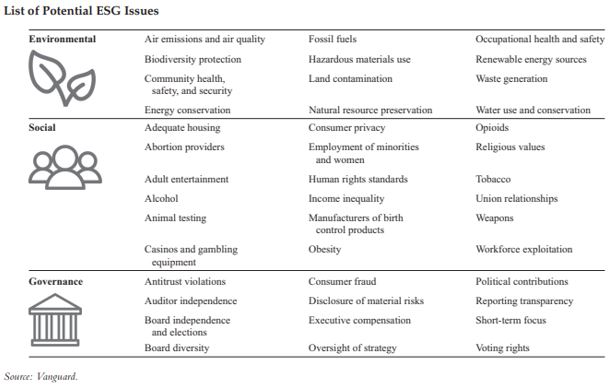

Mark Freeland begins a two-part series, walking through the weird and wild world of ESG investing. This month, he provides an ESG primer (pronounced “primmer” rather than “pry-mer”) that examines key concepts and constraints. In October, he’ll get more into the use of ESG by index makers and fund companies.

Charles Boccadoro, who is summering in Canada, shares the fate of The 100 Club with you. Near the end of the bull market, I wrote a bit about the hundreds of funds that were up over 100% in a year. Charles tracks down the fate of those former titans. (It’s not pretty.)

And a debut! Don Glickstein joins the conversation this month. As you know, we published a death notice for Morningstar’s fund screener, the new version of which has been dumbed down to the point that it occasionally forgets to breathe. Rather than merely mourning the mess, Don reached out to folks at the highest levels of Morningstar to criticize the bog. Perhaps surprisingly, they actually reached back out with explanations and promises.

Finally, The Shadow provides a recap of the industry news – though I have to admit that I’m the one guilty of the snark concerning inverse leveraged single-stock ETFs.

Thanks to them all for their stalwart public service. They make a difference, and I hope you enjoy their work.

A warning about letting your guard down: Don’t.

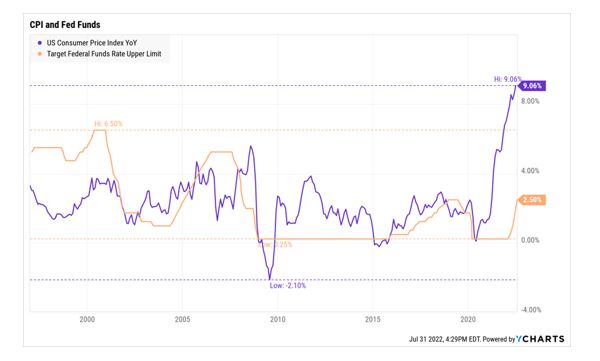

The most famous intervention by the Federal Reserve in the past half-century occurred in 1980, the last time the Fed was confronted with high, persistent, and pernicious inflation. The Fed chair, Paul Volcker (1927-2019), raised the Fed funds rate to 20% in May 1980, saw inflation rise the moment he tried to ease off, slammed the rate back to 20% in December, and kept it above 16% through May 1981.

By contrast, after 75 bps hikes at its last two meetings, the current Fed funds rate target is between 2.25-2.50%. Current options data shows that traders believe that the Fed won’t take rates above 3.3% – just one-seventh of the rate that they’ve imposed before.

The most common description of Volcker’s action is violent, graphic, and accurate: he broke the back of inflation.

To be clear, breaking one’s back is excruciating and crippling. The way he broke inflation’s back was to nearly break the back of every person exposed to the US financial system. The necessity was simple and brutal: he needed to impoverish hundreds of millions of people in order to get them to stop spending money and driving prices up. A recession ensued. Unemployment popped to its highest level since the Great Depression. The number of Americans living in poverty rose by two million. Angry voters raged against the president and the party then in power in the November 1980 elections.

But inflationary expectations and, with them, inflation, were crushed.

That’s all background to an important podcast from Marketplace (29 July 2022), entitled “Enjoy the summer because the Fed drops the hammer this fall.” July saw prodigious gains by risk assets – stocks up 9%, corporate bonds rose nearly 4%, and high-yield corporates up 6% (all measured by the performance of their respective Vanguard ETFs) – which telegraphed one unambiguous message from investors:

Dear Fed. That pain you think you’re inflicting? Ain’t feeling it!

Pretty much the only possible response from the Fed is to move to inflict greater pain, quickly, and with less warning, as a way of shaking investor complacency. The Fed signaled that they want evidence that economic conditions are “appropriately tight,” and a 4% stock market rally in the two days after their latest hike conveys the opposite.

Kai Ryssdal, riffing on a Bloomberg story (“Shock July Stock Rally Was a Monster the Fed May Regret Seeing,” 29 July 2022), warns:

The Federal Reserve, in the person of chair Jay Powell, has been really clear they’re going to raise interest rate as much as they can [to force] people to spend less money, companies to less spend money and thus slow down the economy. [But falling bond yields in July means that money is getting cheaper, not more expensive.] But the markets are saying “hey Jay, pound sand, man. I don’t care what you think.” … This means that the Fed is going to have to, in their September meeting, drop the hammer. “No, no, no. We’re done screwing around.” They’re going to absolutely clobber us. They need to trim these expectations right the bleep now.

Sidebar: What is Marketplace?

A nonprofit news organization, Marketplace is part of American Public Media, one of the largest producers of public radio programming in the world. They have about 14 million daily listeners. And while American Public Media and NPR are both public media brands, we’re two different organizations. They produce some of the best, most accessible economic programming in English. Their mission is to help economics make sense “for the rest of us.” Their tone is light, intelligent, and balanced. Also informal, which might unsettle some. I’d strongly endorse Make Me Smart and Marketplace as daily listens.

What does this mean for investors?

First, it means you have a choice to make. You need to decide to what degree you believe the optimists – traders think the Fed is about done, FundStrat says “the bottom is in,” and we’ve got a 16% upside by year’s end, Morningstar declares that stocks are trading at historically cheap prices – and to what extent you’re willing to bet your financial future that they’re right. If you’re very confident, it’s risk-on time. If you’re not, it’s time for caution.

Second, you might start adding defensive stars to your due diligence list. Over the years, we’ve highlighted funds run by risk managers, that is, folks who understand that the surest path to long-term success is avoiding overconfidence and overexposure to risk. They tend to favor high-quality businesses purchased at a discount and generally have the ability to scale back equity exposure when things get frothy. Articles like the “dry powder gang” series give you a list of such folks. For the nonce, you really need to learn more about such managers.

| Style notes | Performance | Morningstar’s take | MFO’s take | |

| Leuthold Core LCORX | Multi-asset portfolio driven by rigorous quantitative screens. | Top 25% YTD, | Five-star, Gold-rated | Has outperformed its peers, with lower volatility, in every longer-term trailing period |

| FPA Crescent FPACX | Unconstrained multi-asset portfolio whose manager has been getting it right for 30 years | Top 20% YTD, 8.0% over the decade | Three-star, Gold-rated | Since inception, it has returned 2% more annually than its peers with no higher volatility |

| Ariel Global AGLOX | Global large value, manager deeply skeptical of “a market on opioids” | Top 14% YTD, 8.5% over the decade | Four-star, Bronze-rated | MFO Great Owl |

| Palm Valley Capital PVCMX | Small value, two absolute value investors with 50 years of experience between them, still caustic about current valuations | Top 3% YTD, which translates to “is making money this year” | Five-star, Neutral-rated | MFO Great Owl, though on a three-year record |

| Osterweis Strategic Income OSTIX | Multi-asset income fund from a famously independently shop, essentially unconstrained in the search for the most-attractive risk-adjusted opportunities | Top 14% YTD, 6% annually since inception | Five-star, Neutral-rated | MFO Great Owl, MFO Honor Roll, higher returns and lower vol than its multi-asset peers |

| SmartETFs Dividend Builder DIVS | Formerly an active mutual fund, Guinness Atkinson Dividend Builder screens for companies with low debt and consistently growing dividends | Top 13% YTD, top 10% returns for the past 1, 3, 5 and 10 year periods. | Five-star, Silver-rated | MFO Great Owl |

This list is neither exhaustive nor a recommendation to buy. It represents some of the most solid investment vehicles we’ve seen, based on their ability to manage across a variety of markets.

Our recommendations: (1) don’t take silly risks. (2) do take time to learn more about options that have been out of the market’s liquidity-driven sweet spot: speculative, growth, large, and tech.

Let’s All Be Like Bill!

Bill Gates is a remarkable person. In many ways, amazing. In some ways, quite admirable. He’s a guy who changed the world with a project that he began as a 15-year-old. 1590 on the SAT. Started at Harvard, dropped out, wrote code, cut throats, and became the world’s richest person … once on a trajectory to become its first trillionaire.

And then … he changed? I won’t speculate as to why, but his more recent persona might lead us to look at ways To Be Like Bill.

-

Read books! Gates is famously passionate about reading, as is his friend Warren Buffett. The argument they make can be pretty hard-nosed: “if you know only the same things as other people and think only the way they do, you will never achieve anything greater than what they achieve.” Your ignorance becomes self-limiting.

What to read is simple: anything that makes you vaguely uncomfortable, which is only a symptom of a mind being stretched. (Other than on vacation, about the worst use of your time, is reading people whose conclusions are perfectly comfortable and reassuring to you. They’re pandering.)

One of his 2022 recommendations is the science fiction novel The Power (2016), about a world in which women become the dominant sex and form a matriarchy. It helped Gates gain “a stronger and more visceral sense of the abuse and injustice many women experience today.” I’d push for Ursula LeGuin’s Left Hand of Darkness (1969), set on a world in which the inhabitants were alternately male and female during their mating cycles, had no gender otherwise, and described humans as horrifying perverts, as the most thought-provoking book I’ve read in decades.

It’s less well-known that Gates has also written a half dozen books, from Business @ The Speed of Thought (2000) to How to Avoid a Climate Disaster (2021). (Also, too, a guide on programming.)

-

Strive to make a difference in the world! Gates has announced his intention to give away “virtually all” of his $113 billion fortune. In July 2022, he donated $6 billion in stock to the Gates Foundation as part of his plan to get off the list of the world’s richest people. His argument has been pretty straightforward: “I have an obligation to return my resources to society in ways that have the greatest impact for reducing suffering and improving lives and I hope others in positions of great wealth and privilege will step up in this moment too.” His contributions have included $1.5 billion to the United Negro College Fund, $3 billion for global immunization efforts, and a couple billion to fight AIDS, tuberculosis, and malaria. He’s supporting work on a variety of off-the-radar challenges, including the “Reinvent the Toilet” challenge and related sanitation challenges worldwide.

But it doesn’t take billions to make a difference. As one wise person noted, “it might be a drop in the bucket, but the bucket is nothing but a bunch of drops come together.” Demands on your local food banks have spiked, while contributions from grocery stores are dwindling. You can make a difference there through groups like Feeding America. Forests are going up in flames from Arkansas (23,000 acres so far) to California (51,000 acres currently alight). You can plant trees $1 and one tree at a time. Putin continues his brutal war on Ukraine, seeking to wipe the country off the face of the map. While you can’t fight their battles for them, you can surely and easily feed their children and house their homeless elderly.

-

Invest in farmland. Gates owns 269,000 acres of farmland across 18 states, making him the largest private farmland holder in the US. He most recently added 2100 acres in North Dakota. (Local Republicans panicked because of what they perceived as Gates’ anti-meat bias.)

There’s a powerful case for buying farmland and, perhaps especially, timberland. It is uncorrelated with public markets, it seems to be an effective inflation hedge, has low price volatility, and has returned about 11% per year. Many of those virtues stem from the fact that it’s an illiquid asset that requires a steady, long-term commitment (said the guy from Iowa).

Timberland, likewise. It ignores market crises, grows in value from year to year, has historic returns greater than the stock markets, and can be a powerful environmental tool.

For readers who are really, really rich, there’s a fascinating closed-end interval fund to consider: Versus Capital Real Assets (VCRRX), which sports a $500,000 minimum, is up 3.2% YTD, is less volatile than a 60/40 fund, and provides access to timber, farmland and infrastructure investments. (They also refuse to respond to email inquiries, in part because I was trying to find a backdoor for mere mortals.) Because of the complexity of illiquid asset investments, there are no other fund options that I’ve found. But I’m still looking for you.

-

Hang out with sociopaths and cheat on your … Ummm, let’s skip that one.

Thanks!

As ever, to the tens of thousands of folks who share a part of each month with us. If you read something striking, please do take a moment to respond to the author … perhaps tweet the article (we embed links), post a comment to our discussion board, or drop them an admiring (or aggrieved) email. All of us are just [email protected].

Thanks most especially to the folks whose financial support helps keep the lights on and spirits up: The Suranjan Fund, Andrew from Ohio, Paul, Sherwin, and our faithful regulars Greg, William, Brian, William, David, Doug, Wilson, and the folks at S & F Investment Advisors. Cheers to you all!

I’ve spent much of July disconnecting from the need to dash around, recharging a bit, and marveling at our ability to make a difference. As a simple example, when I first bought my little 1970s split foyer house in 2014, I would have been lucky to see 20 bees a day in the yard. This month, after slow and serious attempts to reintroduce native plants in place of swathes of lawn, I wouldn’t be surprised to see 20 species of bees in a day, from carpenters and bumblebees (some big enough to cause flower stalks to bend under their weight) to hoverflies and mason bees. Goldfinches have been at their annual seed raids, and so many birds were plucking viburnum berries that whole bushes quaked. For the first time in rather a while, I’m sort of looking forward to the adventures ahead.

Those adventures will soon include a profile of DGI Balanced Fund (one of the best performing and most distinctive in its class), Harbor International Small Cap (run splendidly by the Cedar Street Asset Management folks), and Port Street Quality Growth (which has been “the next fund we really need to look into” for about two years).

Be good to yourselves!