By Dennis Baran

Objective and strategy

The fund seeks to provide current income with a secondary objective of capital preservation in a rising interest rate and inflationary environment.

The manager’s goal is to achieve a 2% return above inflation, generate income, and protect principal. By managing credit and interest rate risk, limiting duration, and minimizing drawdown to less than 2%, it’s designed to fend against frontal attacks that may ravage the bond market which reduce investor returns and suffocate market enthusiasm.

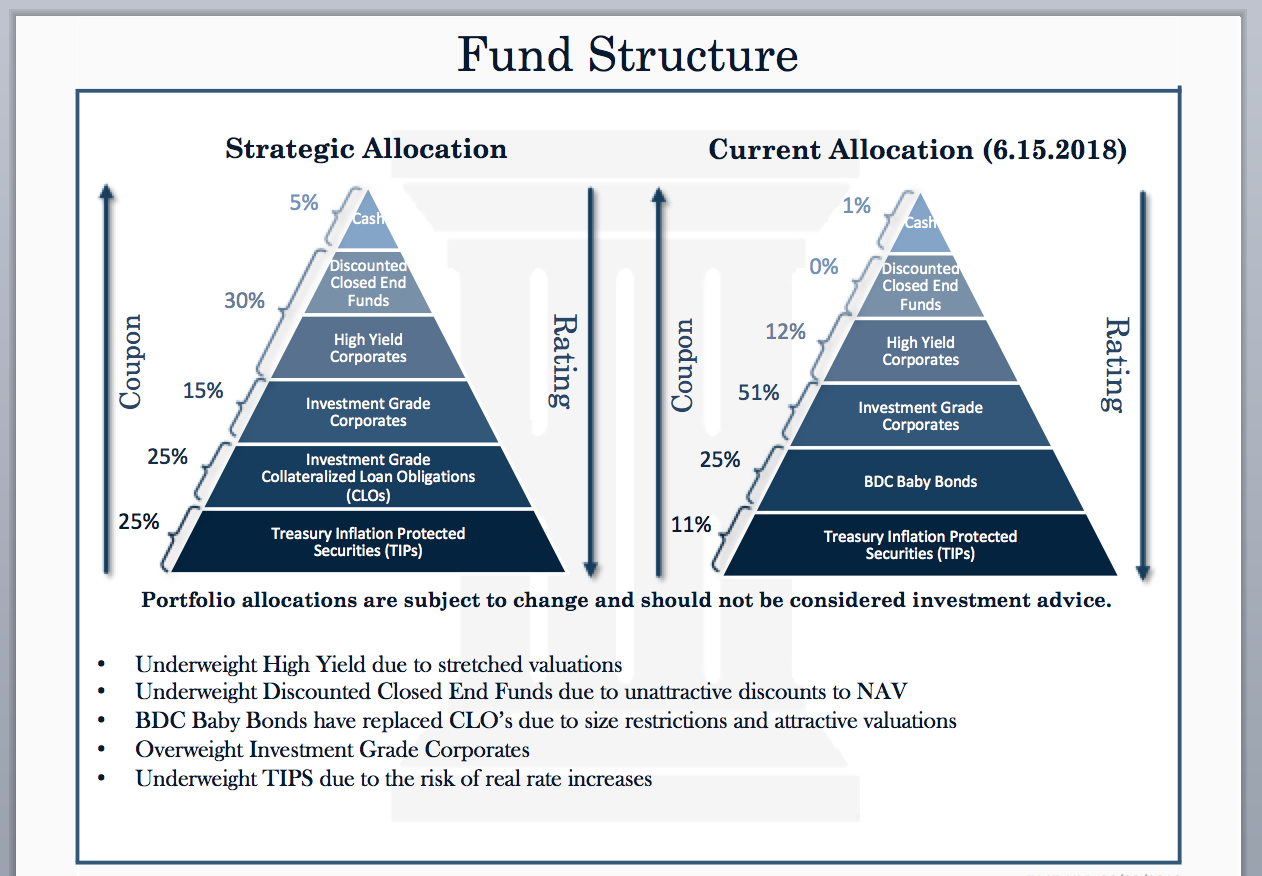

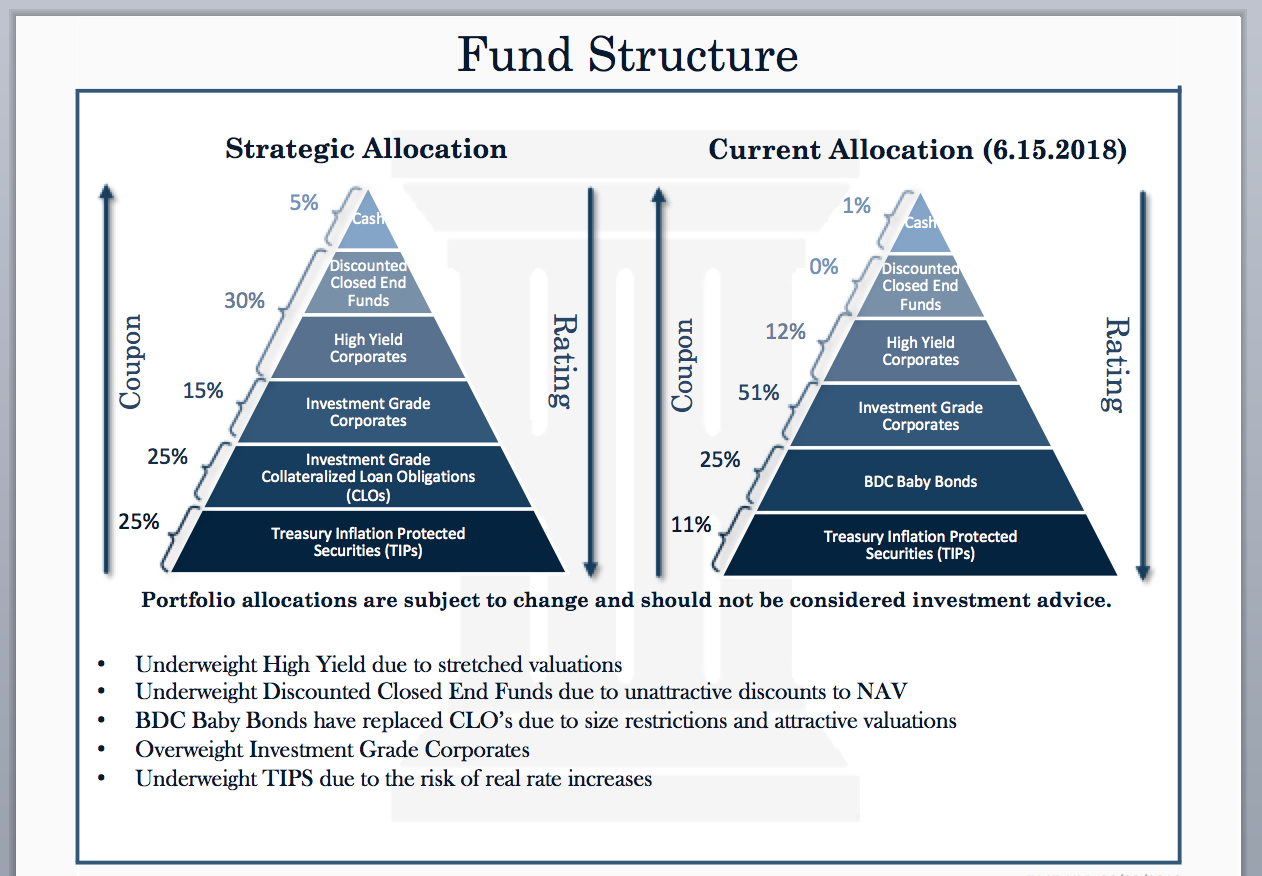

It’s a bold, flexible strategy using a diverse, tactical portfolio targeting allocation to multiple sectors in fixed income securities including investment grade bonds, TIPS, BDC senior notes (Baby Bonds), high yield bonds, CLOs, convertibles, and fixed and floating instruments. Additionally, the manager may invest in preferred stocks, emerging market bonds, and in underlying funds such as ETFs and discounted CEFs. Typically the fund will hold 70% in investment grade securities.

Additionally, the manager has other resources to reach his objectives. These include a top down allocation model, macro-economic projections, fundamental company/industry analysis, and technical analysis of individual issuers to strategically position his holdings. He can hold cash in any amount and use derivatives in underlying investments to reduce certain exposure or hedge volatility.

Holbrook Income is not just a market positioning play, which can change, but rather a distinct placeholder as an income diversifier within the bond asset class.

It’s not expected to outperform if rates move lower. That’s not its objective or its job.

The fund’s benchmark is the Barclay’s U.S. Aggregate Bond Total Return Index.

Adviser

Holbrook Holdings Inc., which is located in Portland, OR. Holbrook’s goal is “to provide high risk-adjusted returns for its clients while maintaining impeccable transparency, open communication, the highest ethical standards, and an empirical approach that provides clients with proprietary research and in-depth market commentary.” Holbrook Income Fund is the firm’s only investment product.

Why Holbrook? The firm was founded in founder Scott Carmack’s home, which had been once owned by Stewart Holbrook (1893-1964). Mr. Holbrook was a sort of colorful figure in Oregon, a one-time logger and provocateur whose three dozen books included Age of the Moguls (1954) and The Golden of Quackery (1959). Mr. Carmack’s wife suggested the name, he liked it, and so the firm was born.

Manager

Scott Carmack.

Mr. Carmack graduated from Harvard University with honors with a degree in economics. He has been involved in the financial markets for 17 years now. The first two were wealth management at J.P. Morgan Private Bank, the next eight proprietary equity trading, and the last seven in fixed income. He has almost six years of portfolio management experience.

He’s always loved the capital markets. Before graduating from Harvard, his competitive energy was focused on sports, baseball and basketball specifically. After graduation, he wanted to find a field that would accommodate his competitive nature. What was his best option?

Finance.

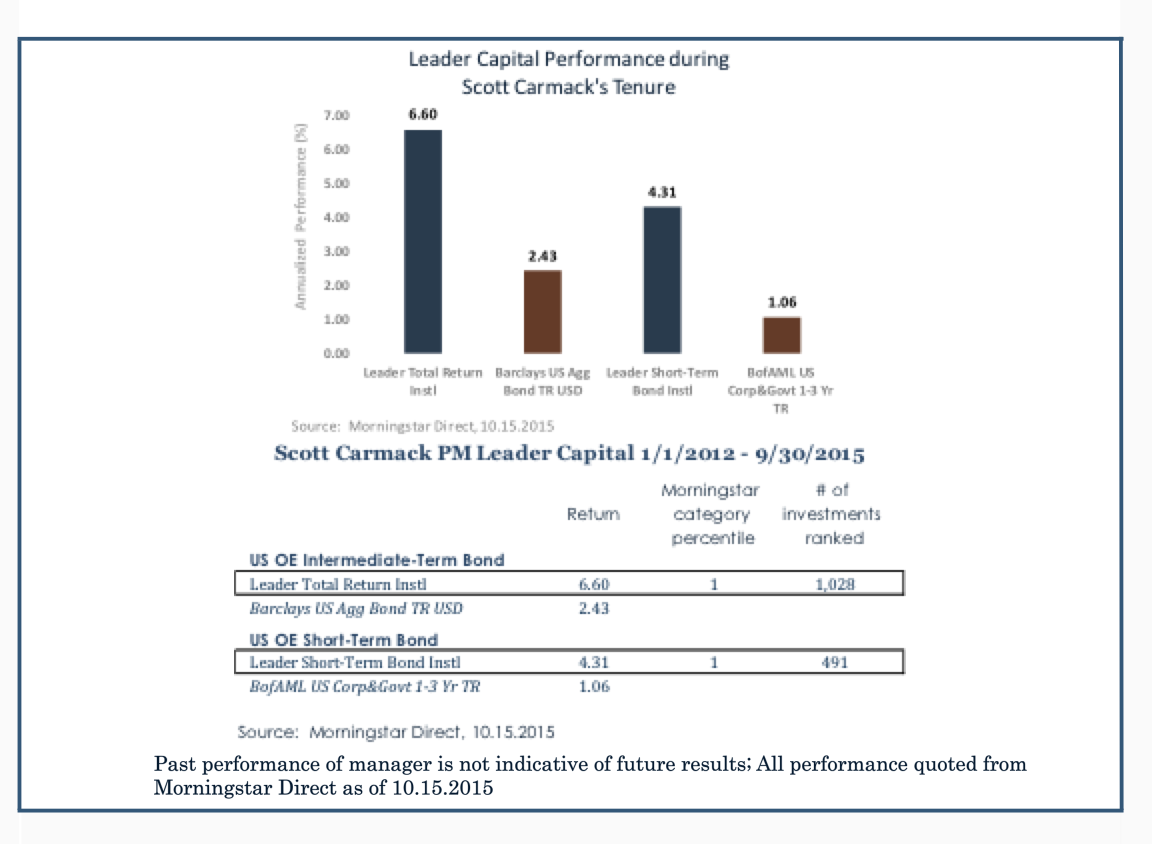

Reason for Launching the Fund

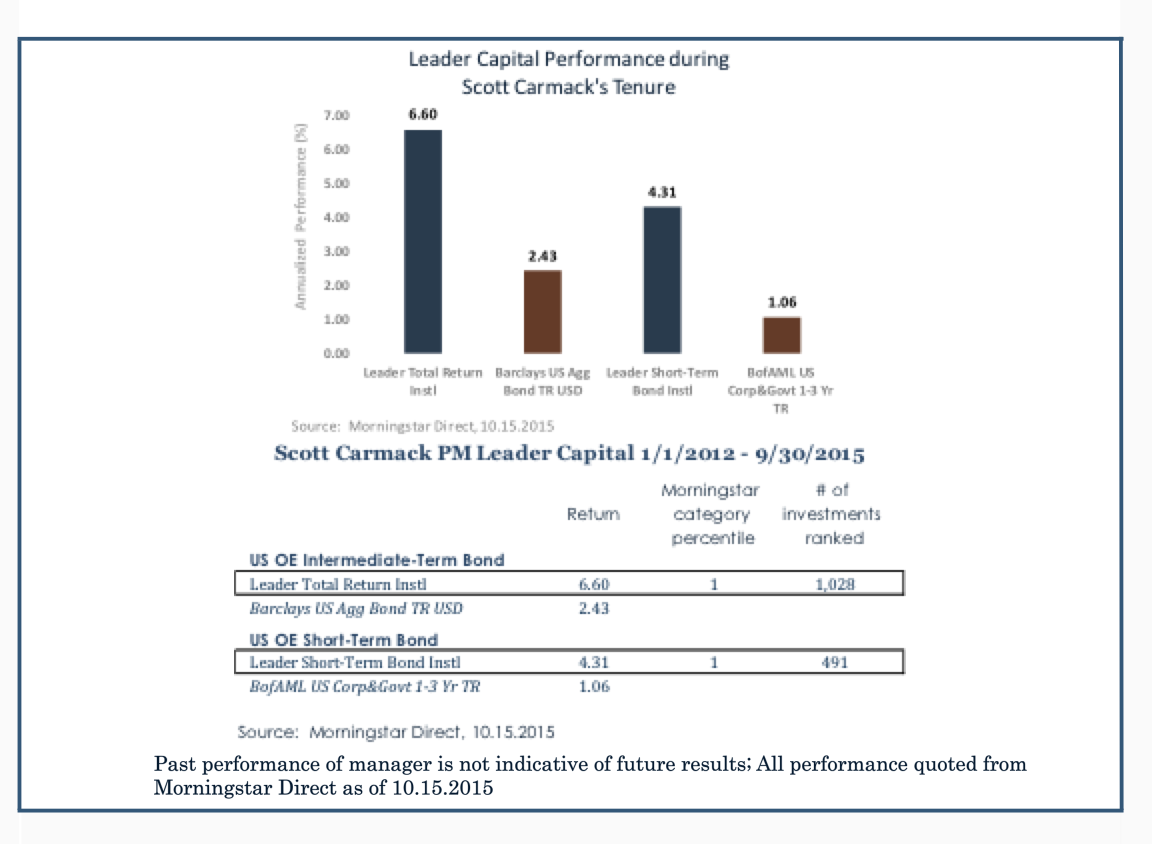

Mr. Carmack worked at Leader Capital from 2011 to 2015, a mutual fund specializing in fixed income, serving first as an analyst, then as a portfolio manager of a short term and intermediate term bond fund, and as President. Morningstar ranked his funds in the 1st percentile for return performance during his tenure.

At Leader, he saw a need for a product that could perform well in a rising interest rate environment and perform as a “fixed income diversifier.” Remember, enormous amounts of money have funneled into fixed income strategies over the last decade, yet many of those strategies are dependent on a low-rate environment. As rates move lower, duration is extended on many benchmarks and funds – a perfect storm for investors. They are more exposed to interest rate risk than ever and at a time where the secular winds are changing. He wanted to launch a fund that didn’t just position for rising rates but one that was designed to outperform in such an environment as its main objective.

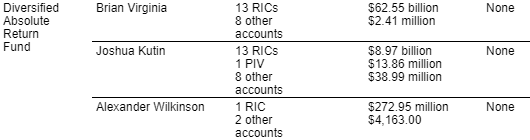

Management’s stake in the fund

Mr. Carmack has invested between $100,001 – $500,000 in his fund. He describes that as all of his retirement savings and the majority of his family’s savings. None of the four trustees own shares.

Strategy capacity

The fund currently has 15M AUM, the majority from independent RIAs, but he expects to be above 20M by the end of June. The strategy is scalable until at least $1.5 billion and probably much higher.

As we’ve noted, Mr. Carmack was able to manage a top -performing fund at those levels and says that he will reassess at that level. But even then, he would be quite small relative to his behemoth competitors and has no intentions to limit assets now. If size compromises performance, he would limit assets immediately.

Opening date

The fund launched July 6, 2016. At slightly under two years, MFO classifies it as an intriguing new fund.

Minimum investment

$100,000 for Institutional Class shares (HOBIX) and $2,500 for Investor Class shares (HOBEX)

The fund is available through some online platforms. The firm has waived some minimums in the short term at certain brokerages. Please consult your brokerage for details.

If investors find that it is not available but have interest, they can call or email Mr. Burns directly to find a solution.

Michael Burns: 503-915-3210; email: [email protected]

Expense ratio

The institutional class is 1.10%(because there is no distribution fee) and the investor class is 1.60% on assets of $1.1B.

Comments

Portfolio turnover

While the fund won’t receive this number until later in June 2018, Mr. Carmack expects it to be between 100-120%. Short duration funds tend to have a higher turnover because many securities mature or are called in any given year. Derivatives for many of the fund’s larger competitors tend to increase the turnover drastically. HOBIX doesn’t use derivatives in its strategies and as a result has less turnover.

The Fund’s Style Box

Lipper classifies HOBIX as a flexible income fund, but Morningstar as a short-term bond fund. Is this an issue?

No.

First, Morningstar does not have a Flexible Income classification.

Mr. Carmack replies that Morningstar puts him in the Short-Term category because of the fund’s duration and investment grade average rating. Typically, the fund’s maturities are 5 years and in. He does expect to have a bit more volatility than other short-term bond funds, but the truth is that the fund probably fits somewhere in between the two styles.

Risk Management

Mr. Carmack uses position limits, sell discipline, and value realization when price targets are achieved. Some example of how macro factors are a part of his portfolio positioning are given later in the discussion under “Key Components In a Flexible Strategy.”

Trade tariffs and political/geopolitical risks are used to the extent that he can get good pricing on credits that he likes. Fundamental changes in these areas are considered after they are enacted and as they affect the fundamental thesis behind an investment. But rarely do such changes affect the binary outcome on a short duration bond and can often lead to great opportunities.

The Manager’s Bond Market View

A one-liner: “Quantitative tightening (QT) will be as harmful to the economy as quantitative easing (QE) was helpful.”

Some bond fund managers agree with his assessment. Like DoubleLine’s Jeffrey Gundlach on June 12th during his own conference call. When we brought up the issue, Gundlach said, “Perfectly logical.”

Why?

Because we are entering a secular bear market for treasuries and that inflation will be a persistent problem for the U.S. For that reason his fund is designed to outperform over a longer period of time.

All of the fundamental requirements are in place.

When he launched in 2016, the excessive bullishness in treasuries and the global negative rate environment were the last requirement for the end of the multi-decade bull market. Demographics were important for his thesis. Many economists contend that an aging society is ultimately deflationary.

He disagrees.

Disinflation and falling rates are the result of a persistent supply glut of labor. In the United States, it started with the Baby Boomers entering the work force and was augmented with the spike in female participation. But as these forces waned in the 1990’s, a far more powerful force emerged – globalization. Suddenly, U.S. companies had access to an enormous supply of foreign labor through off shoring and outsourcing. All of these secular forces are now reversing, he says, and the labor glut will continue to transition to a labor shortage driving wages and prices higher.

Everything we have come to know over the last fifty years will reverse.

Companies will experience margin deterioration, and income inequality will begin to reverse. Firms that have spent the last few decades investing in labor (because it is relatively cheap to capital) will start shifting their inputs and capex will spike, spurring investment and productivity. The cheap labor well is running dry, and with it the secular forces that economists have come to depend on in their models, are changing.

Furthermore, the deflation argument will be debased.

On the surface it might seem that older cohorts consume less; however, from a money flow perspective, this is not the case, especially in what he forecasts to be the political environment moving forward. Older cohorts have a higher marginal propensity to consume: They spend a higher percentage of their income. And while a growing percentage of their income will be sourced from transfer payments (Social Security, Medicare, etc.) all of that is spent and recycled into the economy. Whether it’s financed by savers (the working-age cohort) or through more sovereign debt doesn’t matter. Both are inflationary.

Other Bond Market Views

Fed interest rates

Mr. Carmack believes that there is a risk of a 5th Fed rate hike because the Fed moved 25 bps June 13, 2018 and upped the dot-plot from 3 to 4 hikes this year, in-line with what he expects.

Core inflation is already overshooting their target, and unemployment is well below what the Fed deems full employment at 4.5%. As long as this continues, it will continue to hike.

So, if rates continue higher, he will continue to add exposure to floating rate notes that have maturities in 2020 and 2021 because he thinks that rate hikes will likely be done by then. He likes industrial names for diversification purposes because he’s heavily weighted to financials through his BDC Baby Bond exposure.

Buying at the short end

Mr. Carmack expects the shorter end of the yield curve to offer better yield or income per unit of duration and agrees that as long as the fund’s duration is shorter than his investment horizon, which it generally is, that the fund will benefit from rising rates. It’s even more so when floating-rate, short maturity paper can be sourced.

As stated above, he believes that the Fed will be forced to raise rates even faster than the market and the Fed are forecasting, and so rising rates will definitely benefit him, especially relative to other funds and benchmarks. One of the reasons he doesn’t mind call risk is that re-investment risk favors active managers who can find value in the market at any given time.

He also agrees that many investors have been chasing higher yields from bonds because of declining interest rates throughout QE, including yields in the short-term space; that with the start of QT investors have seen bond yields in the 10-year rise but sporadically; and that there’s the danger that investors seeking to avoid bond market risk (preserving NAV, shortening duration, avoiding inflation) will continue buying at the short end — factors that can affect his credit selection.

He anticipates even more interest in the short-end because of the flat yield curve. His credit selection is very much driven by his macro thesis. For example, he’s overweight financials (specifically BDC), MLP’s, and REITS. The first two are late cycle outperformers, and in the case of MLP’s, are still recovering from the 2014-15 oil route. He sees value there. The latter is a belief that equity REIT’s (malls and otherwise) will still be relevant in an Amazon-dominated world. Typically, these underperform late cycle because of rates, but because they have been so beaten up, he finds value.

Last, the common theme is that after a sector/industry experiences a 2008- like event, it’s typically a good time to invest. These investments are not popular, but they provide good risk/reward criteria for his investors.

Buying IG bonds

We also pointed out that there’s been a lot of issuance in investment grade bonds since 2009, especially in BBB credits – about 30% since ’09 and one level above junk; and that if the economy hits headwinds because of rising rates, increased debt levels, late cycle stimulus, etc. – that these factors could lead to illiquidity and bankruptcy for some of these credits.

His response: Absolutely — and recovery rates will be lower with all of the covenant-lite issuance. This is mainly a problem for high yield. But IG credits will be faced with price volatility, and he will use that to his advantage in the names that he likes. Again, much of his BBB-credit exposure and high yield exposure are in industries that he expects to outperform in the late stages of an economic expansion.

What has the manager avoided?

MBS, RMBS, EM, and COCOs.

For MBS and RMBS, it’s just not his expertise, and much of the sector is vulnerable to rising rates, so it just doesn’t fit in for the fund. Dollar denominated EM bonds are starting to look attractive, but because he finds similar returns domestically, he’s chosen not to take on the added geopolitical risk. COCOs will only have a place in his portfolio if they drop to pennies on the dollar.

Views about the next recession

In his outlook for 2018, Mr. Carmack said that he didn’t believe a recession would occur this year but more likely in 2020 because of the Fed’s continued tightening and other factors. He also outlined how he would then modify his portfolio.

It remains his thesis that a recession is more likely in 2020. Investors can’t believe how long this expansion has lasted, but if one plots real GDP growth overtime, a person starts to realize that the cycles continue to be longer and longer. Much of this has to do with the Federal Reserve and that larger economies are typically less volatile.

He can’t modify a portfolio in recession – it’s too late.

By the time the U.S. is in recession, he’ll be adding risk. But in preparation for recession, he’ll minimize high yield, pare back lower-rated IG, and move from floating to fixed coupons — in that order. In fact, he’s already started by paring back high yield.

What else? Increasing his TIPS position and probably extending duration in those securities as break-even rates fall.

It’s also his view that the next recession and the Fed response to it will be much different than what the market expects. Investors think that the Fed will automatically cut rates to zero and embark on massive QE. However, he believes that inflation will make their easing cycle much different and is one of the reasons why TIPS will be the risk-off security, not nominal treasuries.

Key Components in a Flexible Strategy

The fund has found relative value among diverse income producing assets by being strategic and tactical.

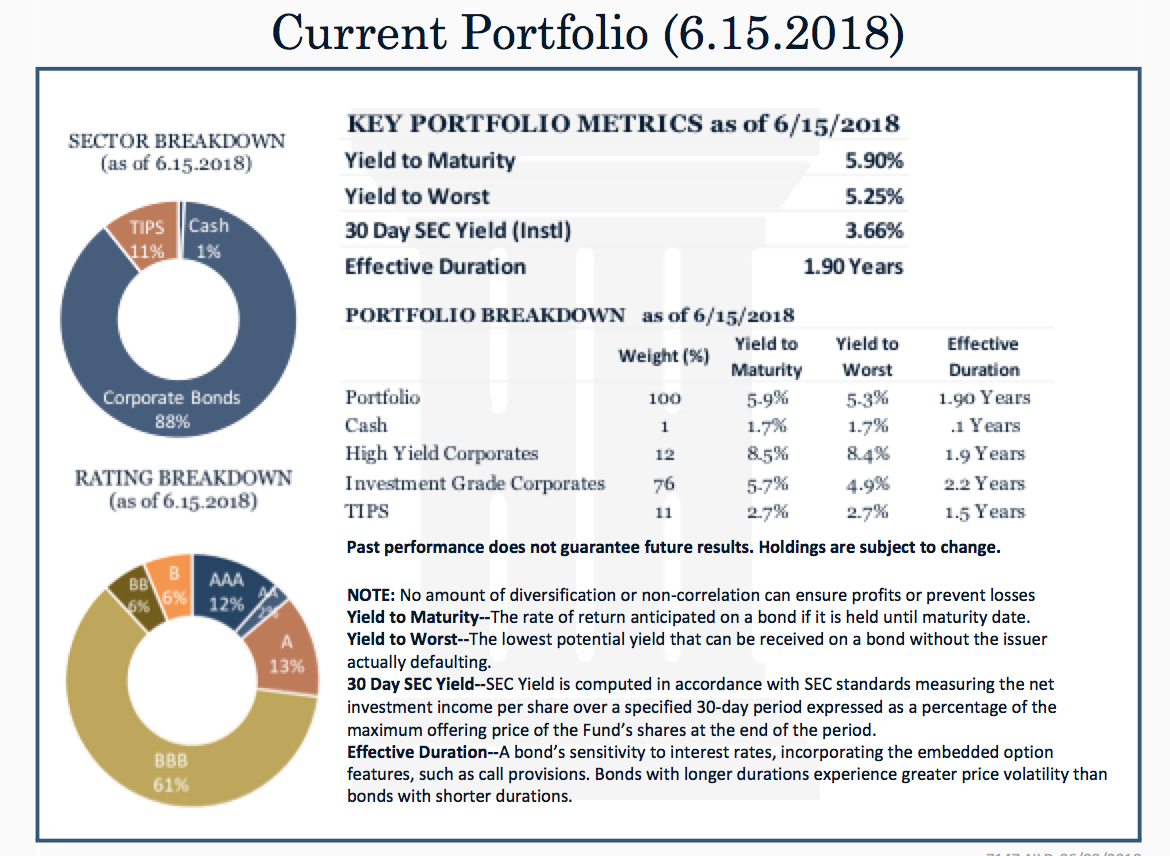

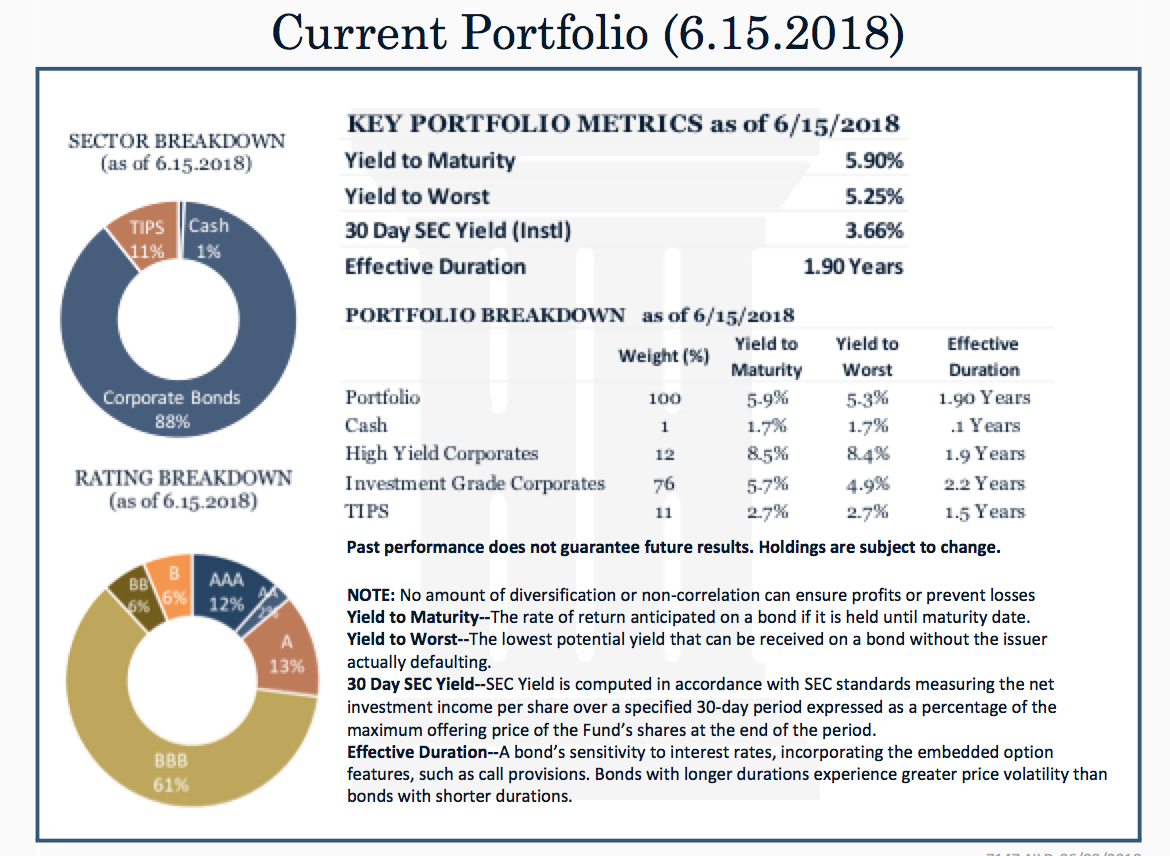

Here’s what the allocation looks like as of June 15, 2018.

Let’s zero in.

TIPS

TIPS are an important part of the portfolio construction and strategically have a 25% allocation over the long term. TIPS provide inflation protection, AAA rating, liquidity, and non-correlation with the corporate exposure in the portfolio.

Since inception, TIPS exposure has ranged between 10% and 25% of the portfolio and is currently at 11% with all maturities within 5 years. While not being super-bullish on TIPS, he says that they still provide value in the portfolio and serve to meet his second prospectus objective of preserving capital in a rising interest rate environment.

While breakeven rates dictate the attractiveness of TIPS relative to nominal treasuries, they don’t indicate their relative value to other corporate securities. But, because Mr. Carmack chooses to remain fully invested, he carries a small cash position so that he can take advantage of opportunities in the corporate market quickly. The liquidity in TIPS enables him to sell quickly if he needs cash and meet unexpected redemptions without having to sell securities that represent good value.

In terms of relative value, TIPS have outperformed treasuries handily over the last year. For example, the breakeven inflation rate on a 5-year treasury has gone from 1.55% to 2.07%, but real rates continue to move higher, and so the asset class in general has been down over the last year.

For example, the real 5-year rate has moved from 20 bps to 70 bps over the last year, which equates to an approximate 2% loss in the 5-year TIP. He expects breakeven rates to continue higher, potentially eclipsing 3% in the next 12 months; however, with the Federal Reserve continuing its hawkish stance, he also believes that real rates will continue to move higher in the near term, a considerable headwind to the asset class.

Ultimately, he thinks that the Federal Reserve will have to decide which mandate is more important — unemployment or inflation. If the Fed errs on the side of employment, which he suspects, TIPS will become an even more attractive asset class as inflation targets will become less rigid. When this begins to play out, he will likely be at a 25% strategic allocation in TIPS. While he doesn’t expect great returns from TIPS in the near future, he certainly believes that they will outperform treasuries.

His TIPS exposure at the short-end of the curve below 5 years is simple to explain. The pick-up in real yield gained from investing in a 2-year TIP versus a 10-year TIP is only 4 bps.

Investors are not being compensated for the additional real yield duration.

Baby Bonds (BDCs)

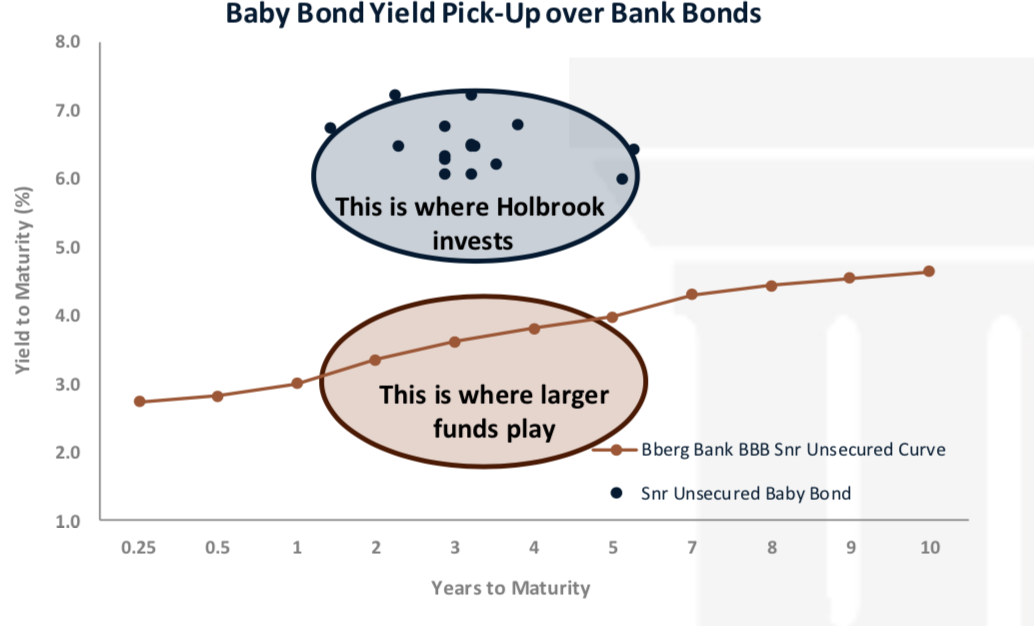

One key component for Mr. Carmack is his allocation to Business Developing Companies (BDCs) Senior Unsecured Baby Bonds, now at 25% of his portfolio — investment grade — and traded on an exchange.

They’re attractive because of their IG rating and because the regulatory restrictions for these companies mandate that they maintain an asset coverage ratio by 150%. (A bill passed called the “Small Business Credit Availability Act” changed the asset coverage ratio from 200% to 150%.). If their asset coverage ratio dips below this level, they are mandated to stop equity distributions to shareholders or buy back their Baby Bonds until they comply with the 1.5x coverage mandate.

The rest of the covenants remain largely the same, and it doesn’t change his outlook on them.

These regulations are extremely bondholder friendly and offer him a margin of safety.

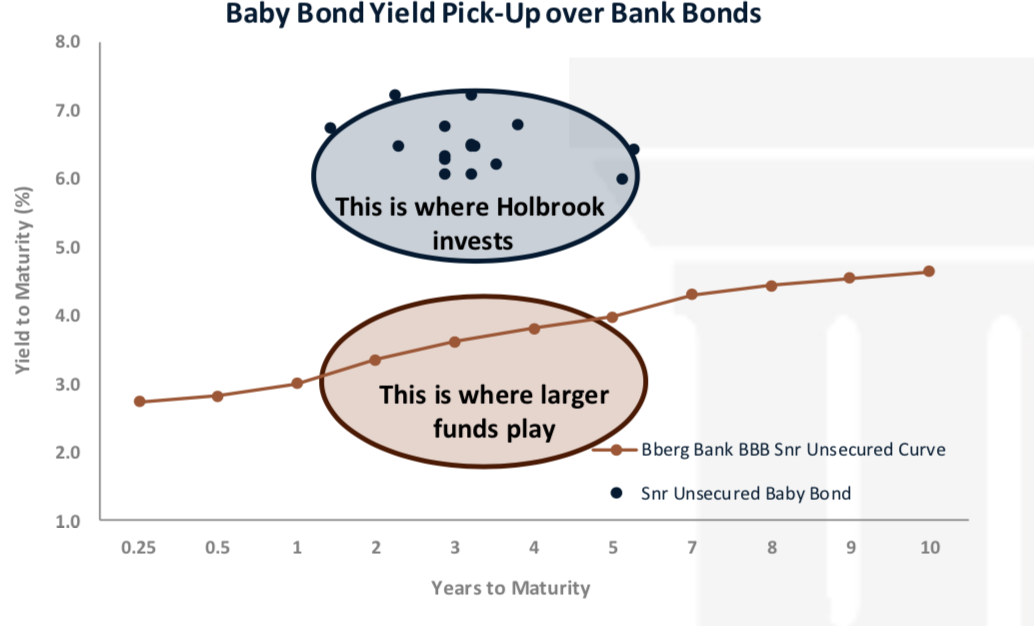

What about their yield?

It’s considerably more than bank bonds of similar duration. Currently, the fund is getting between 4% and 7% yields for 3-6 year maturities.

Plus they have less financial leverage than their commercial bank counterparts, and because the Baby Bond market is considerably smaller than the bank bond market, it’s difficult to access for larger funds, adding to the fund’s opportunity set as a small fund.

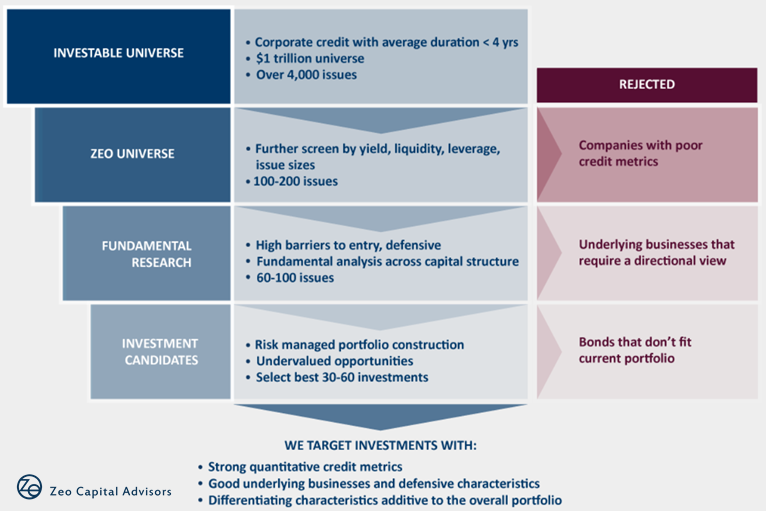

Here’s a helpful chart.

Notice at the lower right corner where the fund lives vs. larger companies along the yield curve.

He expects his AUM to increase over the next 6 months, and if it does, he plans to substitute some of this exposure with investment grade collateralized loan obligations that have floating rate coupons which support his mandate of outperforming in a rising rate environment.

Flexibility at work.

High Yield Corporates

High yield corporates have been reduced because spreads are at multi-decade lows, and the asset class is abundant with credit and rate risk.

His positioning in high yield is determined by reversion to the mean of spreads over treasuries. He will lower his exposure from his 30% strategic positioning when these spreads are historically tight and increases it – up to 50% — when they are wide. Currently he has minimum high yield exposure.

Preferred Stock

The fund has had minimal exposure to preferred stock since inception. What preferreds it has owned are all fix-to-float with short call dates but have never been a large part of the portfolio.

Cash

Generally, HOBIX is fully invested. High cash balances at the end of a month are due to inflows before month-end and are usually quickly deployed in the issues where he finds values at the time.

Recent Portfolio Allocation

The portfolio is over 88% investment grade and at least 70%, per prospectus. Its current effective duration is 1.90 years and has ranged between 1-3 years since inception.

Investors using Morningstar to view the portfolio need to know that the allocations shown are dated January 31, 2018 and show a major discrepancy from the chart above. Please refer to the information under “Preferreds” given earlier. The correct information appears on the fund’s website, and Morningstar is in the process of updating what their website currently shows.

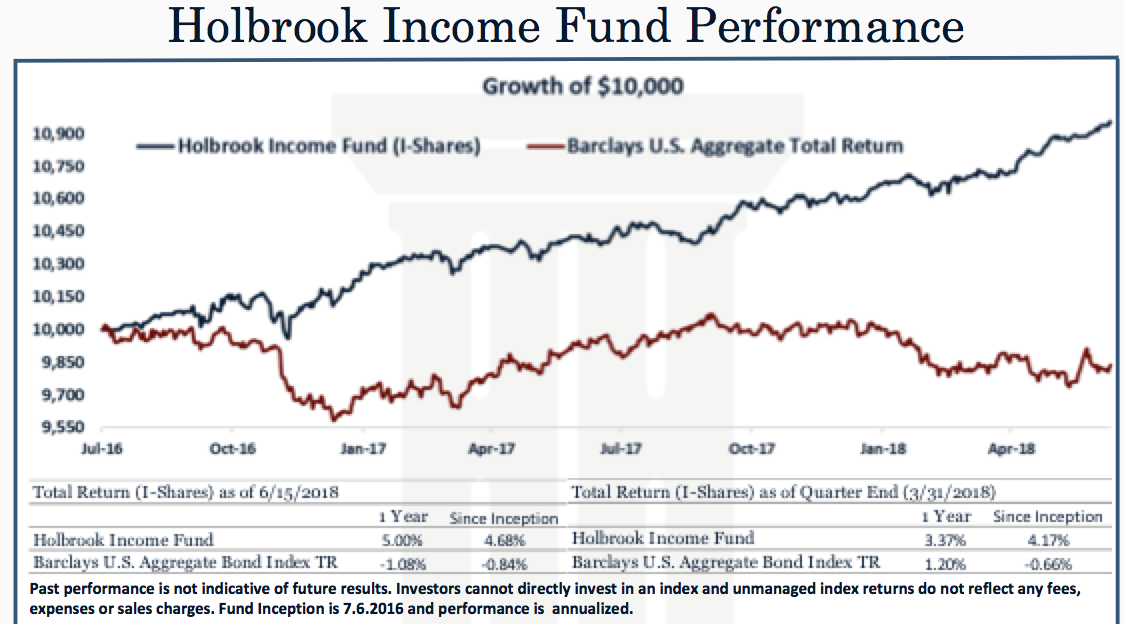

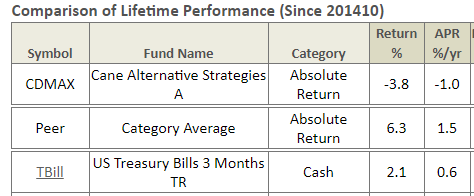

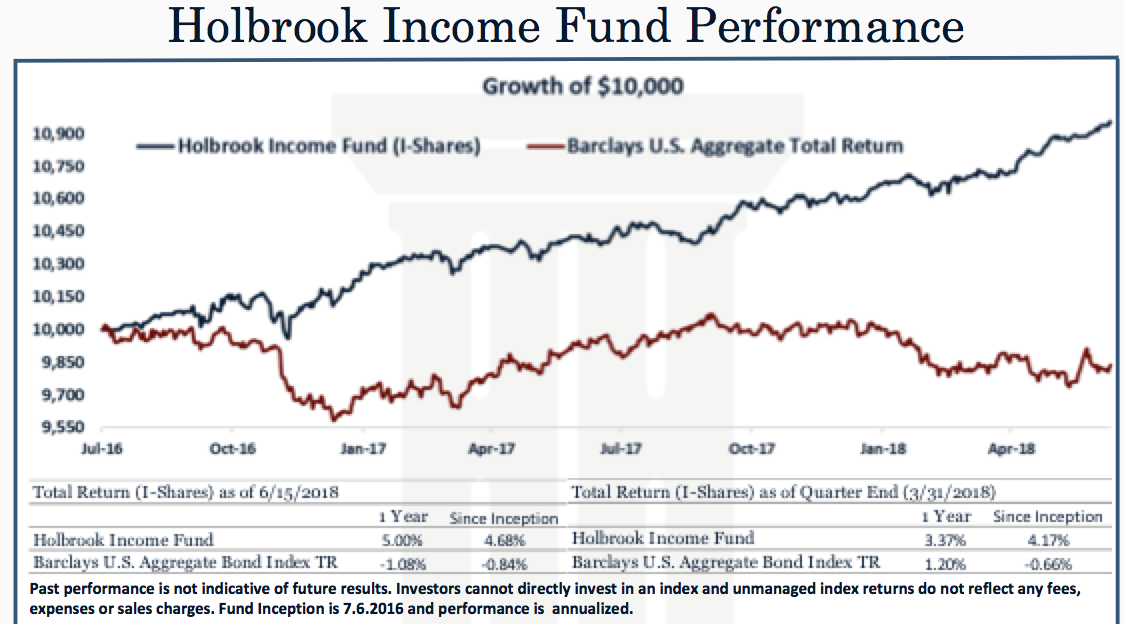

Performance

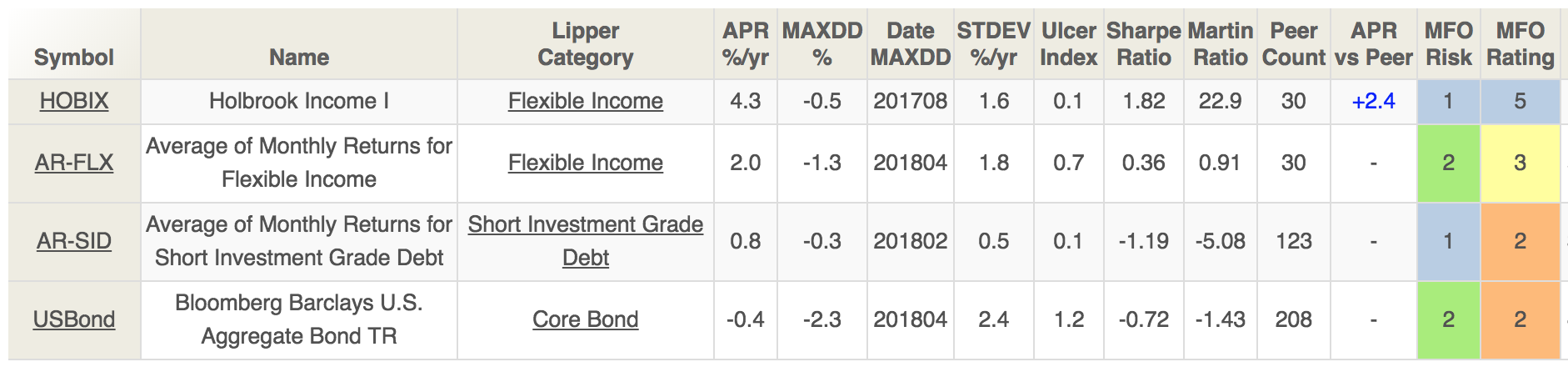

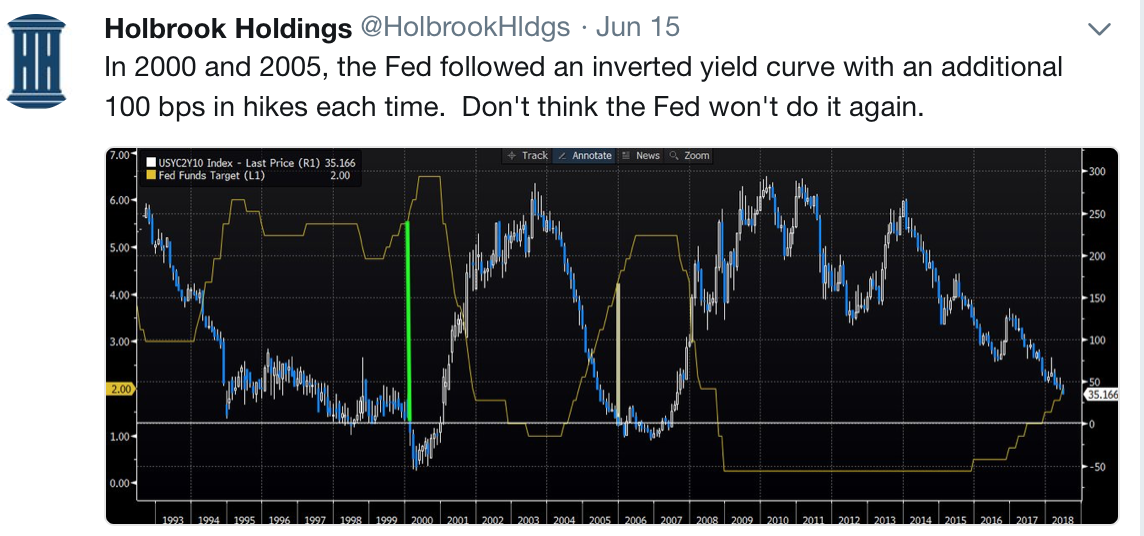

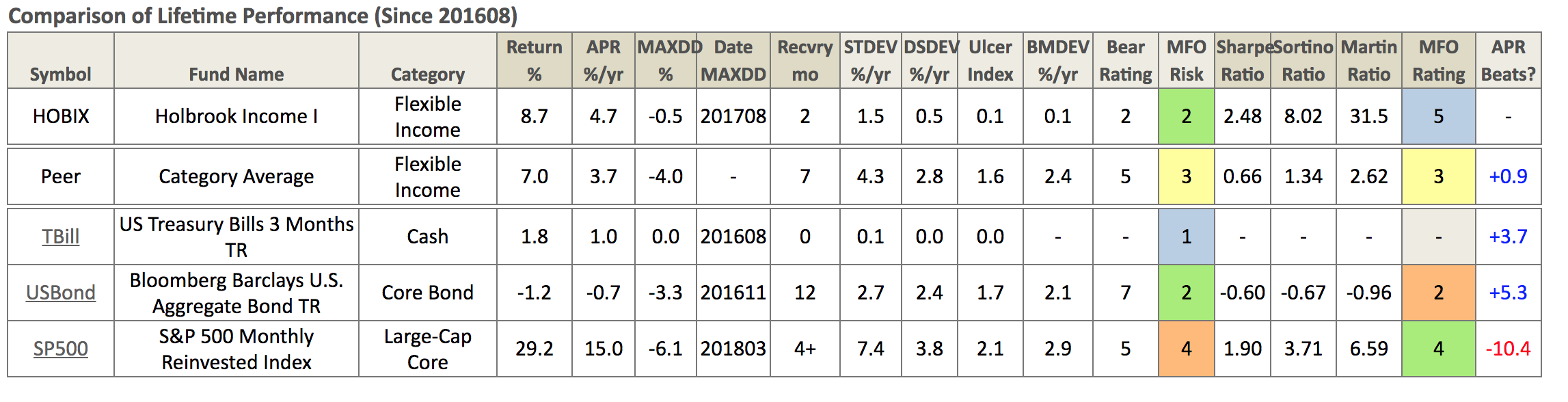

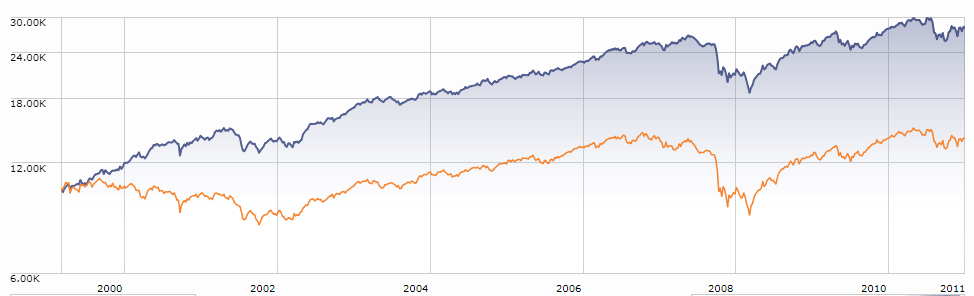

Here’s the performance through June 15, 2018, since inception, and as of quarter end March 31, 2018.

Since inception the fund has returned 4.68%. The Barclay’s Aggregate Bond Index Total Return has returned -0.84 percent.

As of June 15, 2018, the fund has returned 2.78%. Its yield is 3.60%.

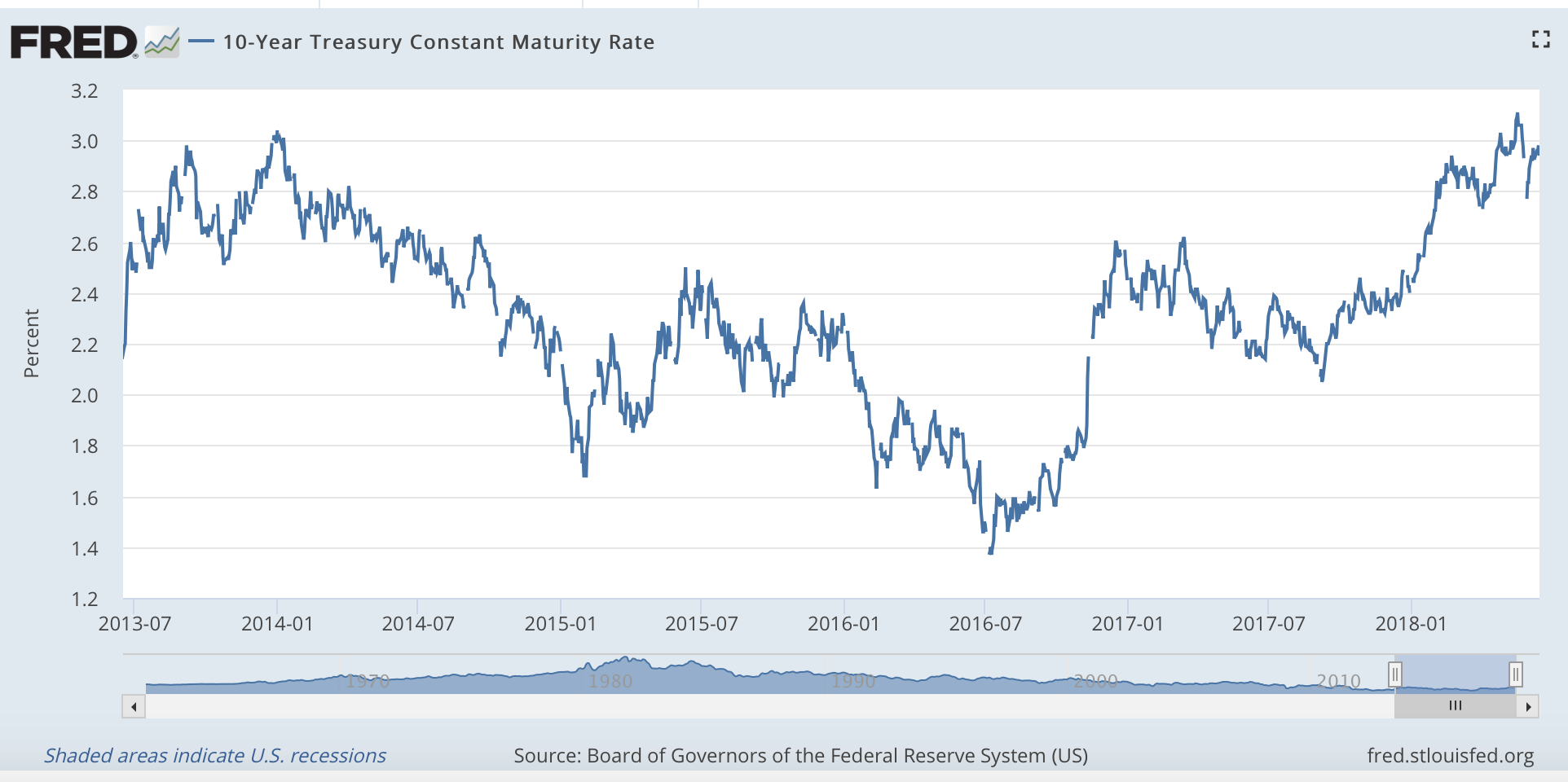

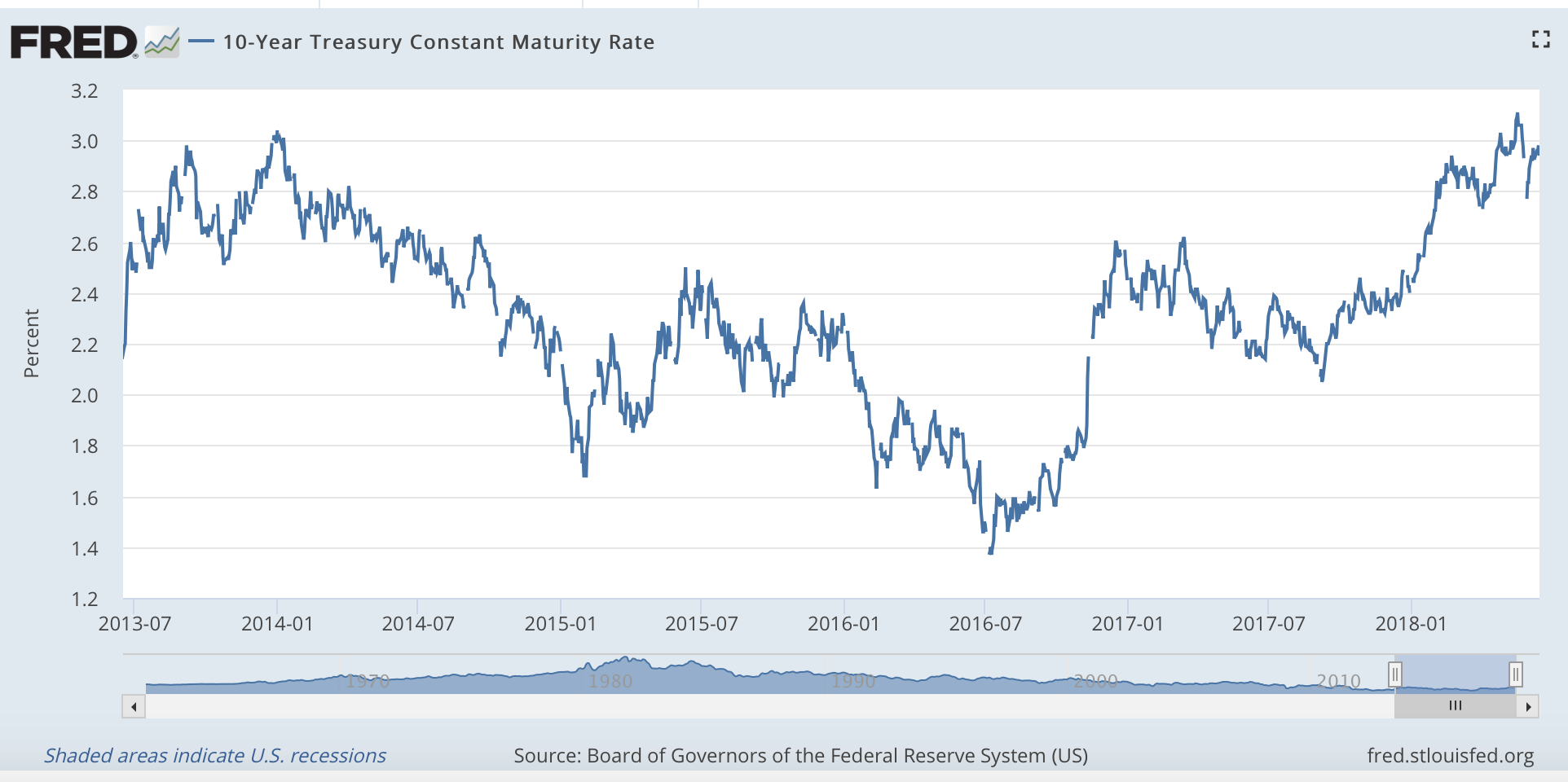

Its launch was propitious: It opened July 6, 2016 on the day that the 10-year treasury yield hit a low at 1.37%.

Let’s look.

The interest rate at the bottom of the 2016-07 period is the 10-year low at 1.37% on July 6, 2016, an increase of 158 BPS to an interim high of 2.95% shown at the upper right on June 15, 2018.

While it was not Mr. Carmack’s intent to launch the fund that very day, the spike in rates for nearly two years after launch illustrates how the strategic composition of the fund can generate income and protect net asset value in an environment that challenges many bond strategies.

And remember, during this time the fund returned 4.68%.

According to Morningstar, the fund has been in the 1st percent YTD in the short-term bond category and for one year ending June 15, 2018. The fund will be two years old on July 6, 2018 and may earn that rank then too.

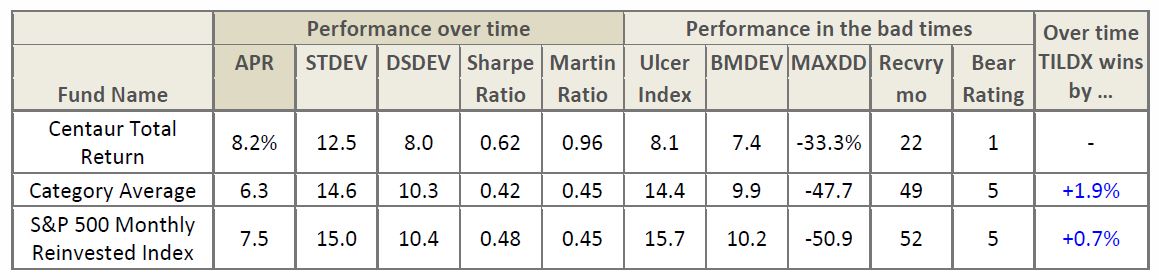

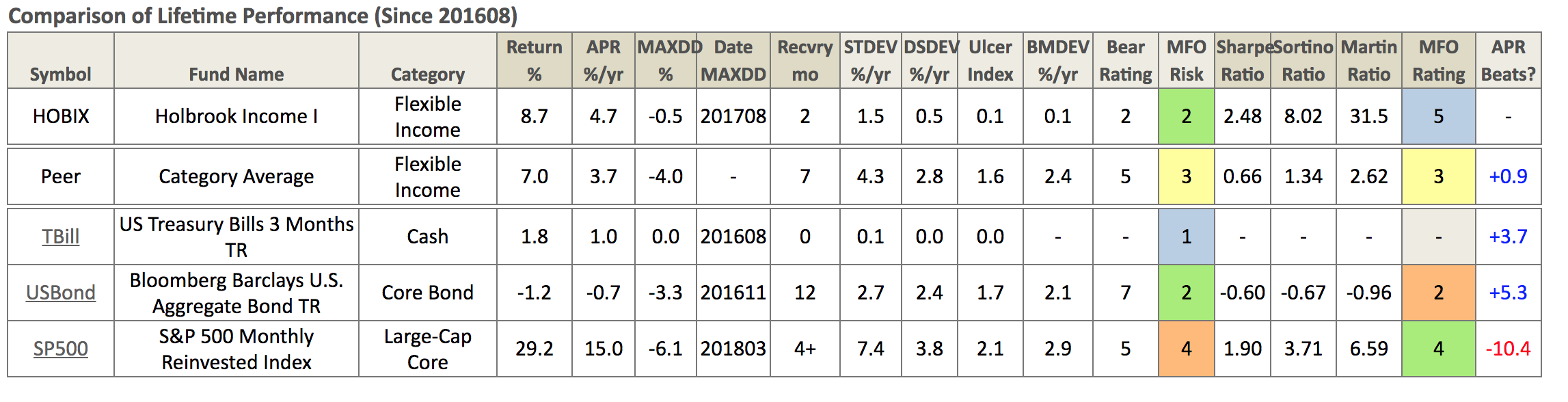

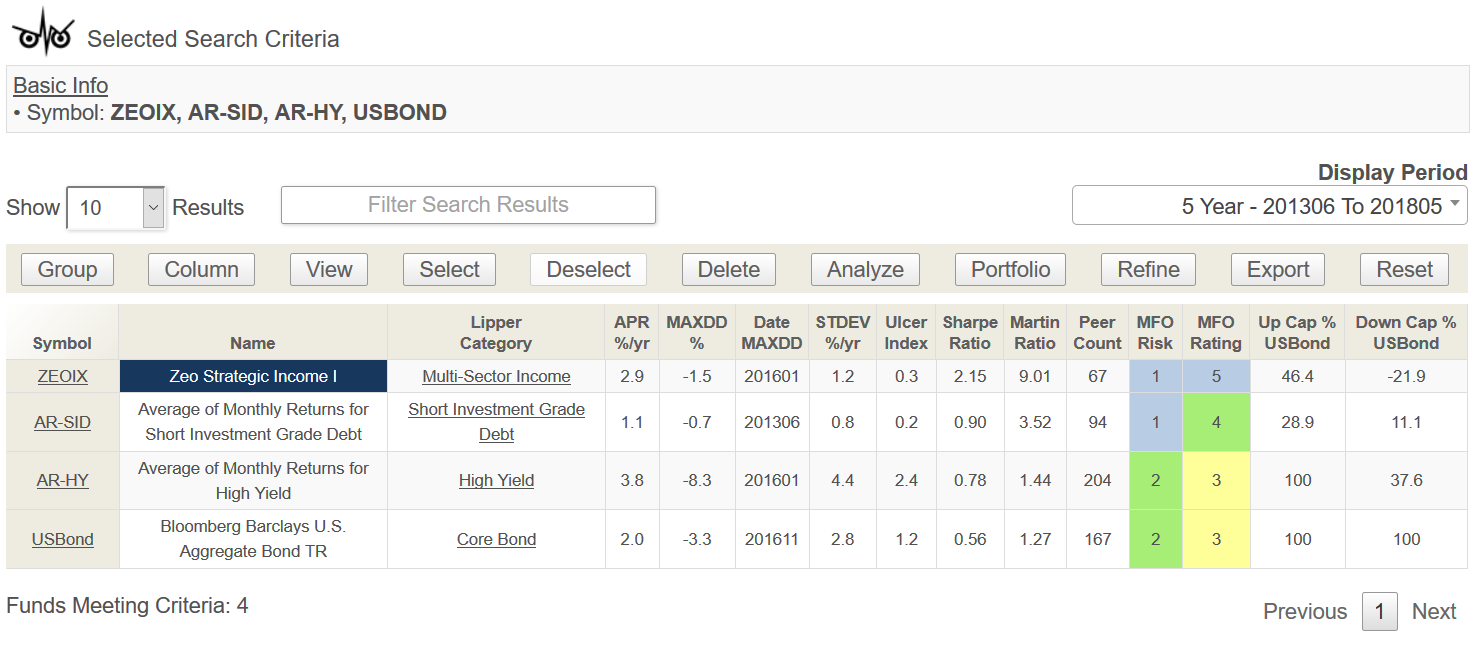

As of May 31, 2018, MFO shows the fund doing extremely well against its peers and its Barclay’s bogy.

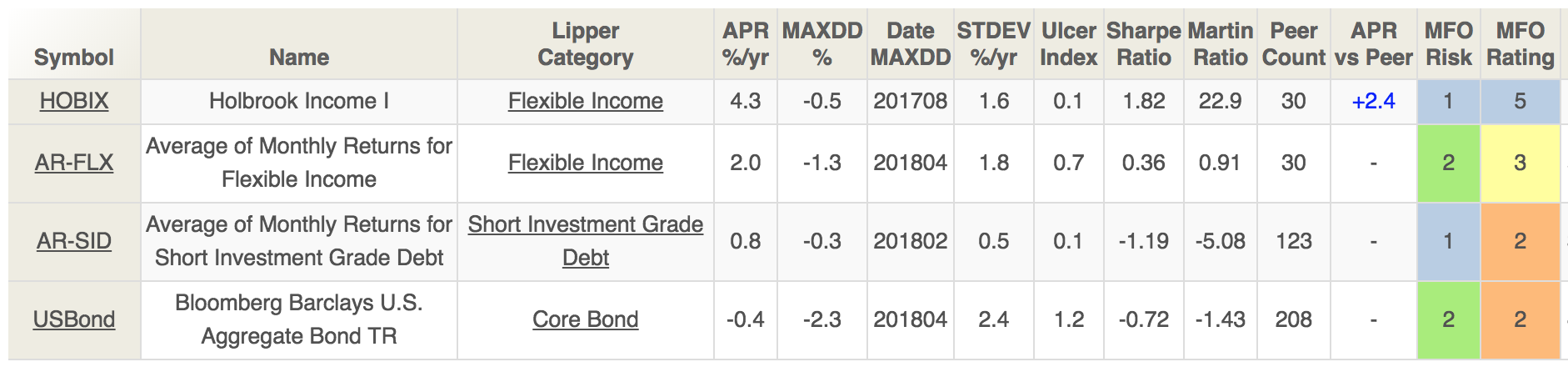

How has it done vs. Flexible Income and Short Investment Grade Debt?

Here’s the fund’s 1-yr. performance.

Its 1-year MFO Risk performance now has a Risk Rating of 1.

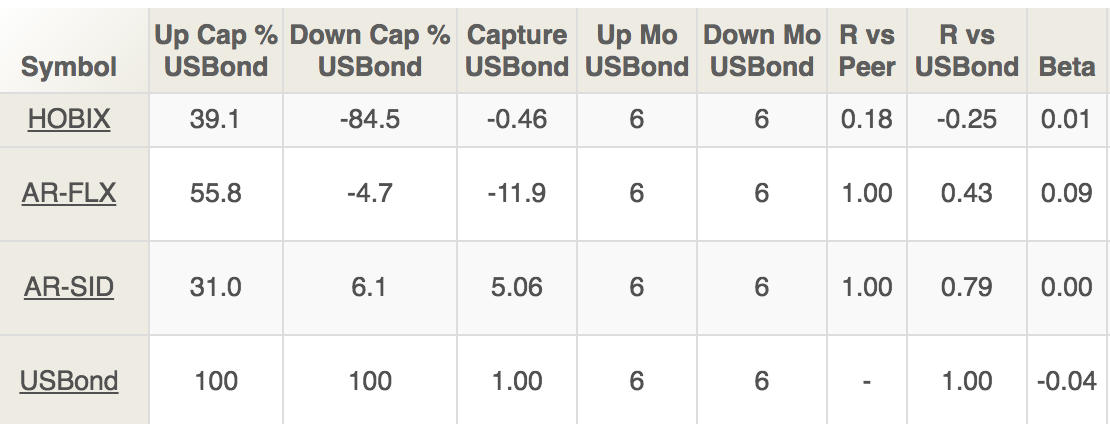

Examining the fund’s Upside and Downside Capture Ratios for one year vs. the Flexible Income Category, the Short Term Investment Grade Debt category, and the Barclay’s Aggregate TR Index is quite relevant.

The downside capture indicates that when the Barclays Aggregate was down, the fund was positive 84.5% of the benchmark’s negative return. So if the Barclay’s Aggregate was down 2%, which it was, the fund was up 1.69%.

Because the fund’s objective is to preserve NAV in a rising interest rate environment, it expects to have a negative downside capture ratio. Also, if it has a negative upside capture ratio, that demonstrates that it’s serving as an income diversifier. Capturing the Barclay’s positive returns adds additional value.

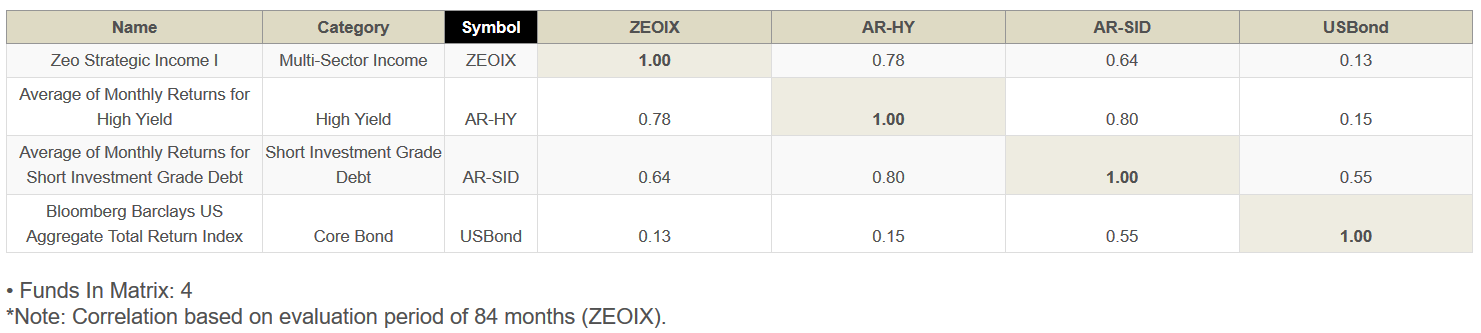

MFO Premium data also shows that the fund’s lifetime correlation is 0.39 compared to its peers and 0.09 compared to the Barclay’s US Aggregate Total Return Index.

To keep his performance above average to avoid mean reversion, Mr. Carmack would shorten his maturity profile when he believes there is a significant risk to corporate credit, improve credit quality by increasing his TIPs exposure, and continue to decrease high yield.

Although the fund is young at 1.9 years, its early returns demonstrate that the manager’s anchored flexible strategy has fulfilled what he’s set out to do and earned his keep.

Bottom Line

HOBIX attempts to be fully armored for complete protection against interest rate and inflationary increases, two components of bond warfare that bludgeon forays into the asset class. It has been bullish on risk since inception.

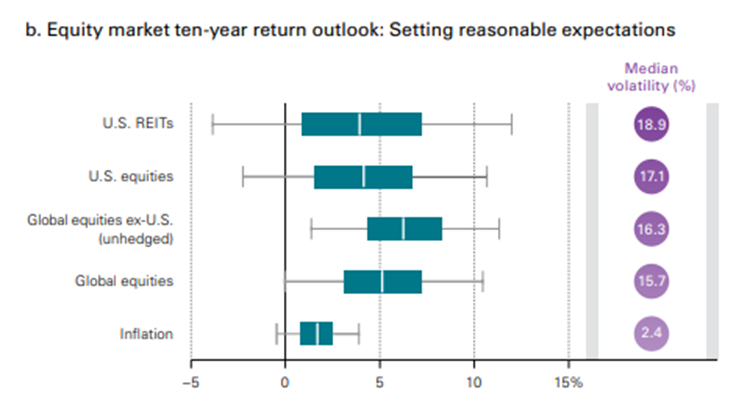

Mr. Carmack believes that traditional core bond strategies and indices are not irrelevant because they can do a good job when exogenous events roil the market. But investors need diversification and a product that will perform well when the rest of their fixed-income portfolio is facing headwinds, and now is the time to have exposure to income producing products that perform better in a rising interest rate environment.

If he underperforms when every other bond fund outperforms because rates move drastically lower, he can live with that.

With the beginning stages of a multi-year uptick in bond yields, he does not favor fixed coupon bonds, treasury, or otherwise.

Most importantly, his attention to outperformance combined with a competitive nature doesn’t mean that he’s trying to shoot the lights out.

Remember, if he can return 2% above the rate of inflation on a long-term basis and keep his drawdowns under 2%, he’s doing his job.

HOBIX is not a go-anywhere fund.

His strategic core as shown earlier is intrinsic: It’s not traded around. He’ll add on weakness, pare on strength but maintain those basic positions. It has a solid fundamental thesis both macro and micro and is not based on intraday, intra-quarter, or even intra-year moves.

Also, Mr. Carmack openly tells investors that the environment that he expects is actually the hardest in which to make money – even for his fund – because of increased interest rates to all fixed income. His galvanized strategy is an attempt to create a fortified defense against bond market shocks that would destroy investor returns.

The bond market can behave like one of the most intelligent of creatures — and as one of the most perverse. Investors have become complacent about their exposure to bonds over the last decade and embraced strategies dependent on a low-rate environment.

The bottom line is clear: Mr. Carmack has made money for investors since inception.

While he may not know what price investors have to pay from market disruption nor what fortunes may be told, he has constructed a number of financial building blocks that are a solid bulwark against market turbulence. His itinerary is no random journey through an asset class but a direct flight path with his grass roots aboard.

For investors wishing to reach his destination, he has given them a map to get there.

Website

Holbrook Advisors

Holbrook Income

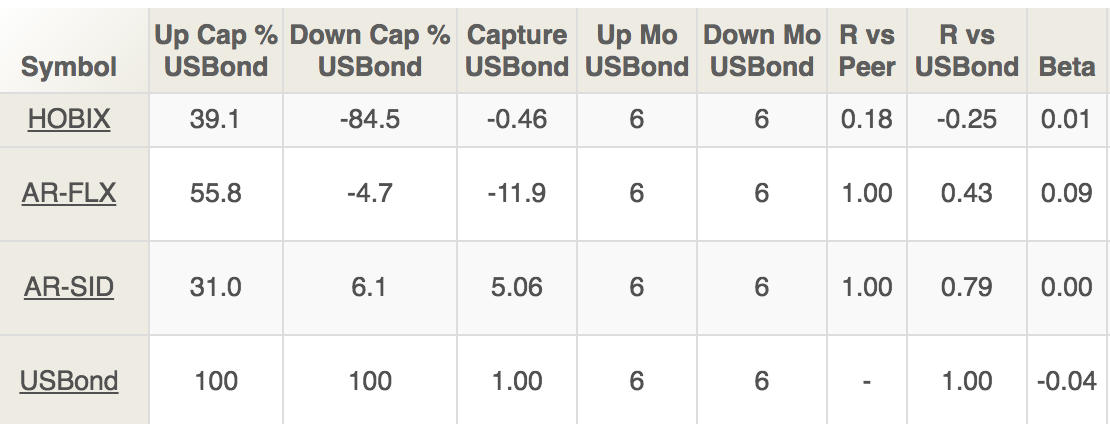

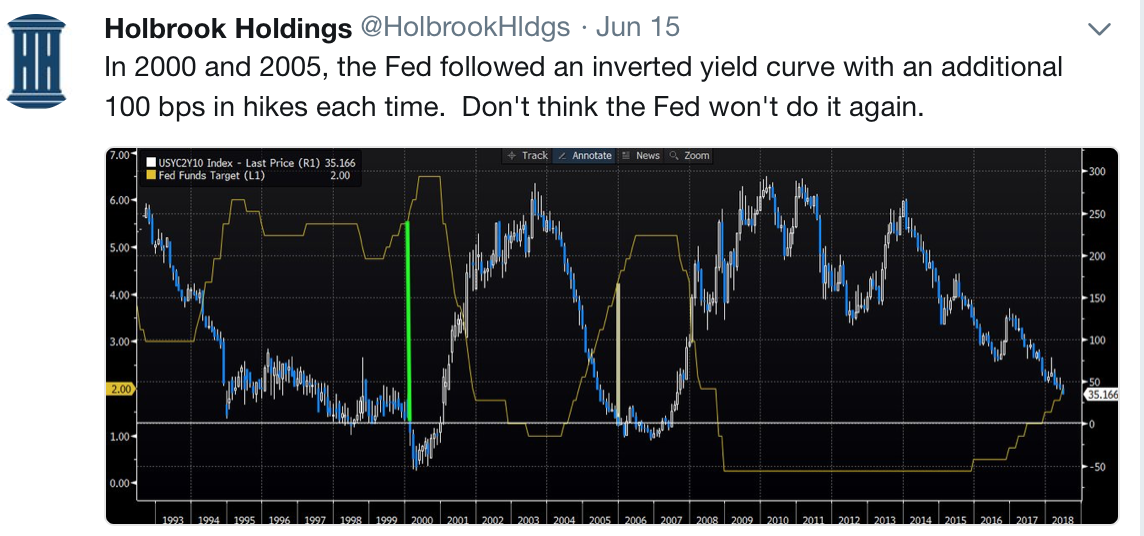

Both include Mr. Carmack’s Newsletter and Perspective, each given once per quarter and sent to others. They’re worthwhile – lucid, in-depth, provocative, bold. Also, his views @HolbrookHldgs usually show daily responses to current events happening in the market as shown here from June 15, 2018.

On May 30, 2018, AMG launched AMG TimesSquare Global Small Cap (TSYNX / TSYIX), the fifth AMG fund sub-advised by TimesSquare Capital Management. TimesSquare is a growth-equity firm that works primarily with institutional clients. They manage about $18 billion in assets.

On May 30, 2018, AMG launched AMG TimesSquare Global Small Cap (TSYNX / TSYIX), the fifth AMG fund sub-advised by TimesSquare Capital Management. TimesSquare is a growth-equity firm that works primarily with institutional clients. They manage about $18 billion in assets.

We’ve got Coke Zero. We’ve got Pepsi Zero. I guess it’s reasonable to wonder, why not Fidelity Zero?

We’ve got Coke Zero. We’ve got Pepsi Zero. I guess it’s reasonable to wonder, why not Fidelity Zero? Offering two loss leader funds is a nice marketing gimmick, akin to a supermarket’s decision to offer blueberries at $0.99 per pint that they’ll inspire you to grab some organic quinoa or King Crab legs while you’re there. It might even be economically sustainable.

Offering two loss leader funds is a nice marketing gimmick, akin to a supermarket’s decision to offer blueberries at $0.99 per pint that they’ll inspire you to grab some organic quinoa or King Crab legs while you’re there. It might even be economically sustainable.

Many “active” managers, of course, provide neither intelligent risk management nor meaningful relationships. Like the dodo, they’re mostly praying that no one notices and, unlike the dodo, they mostly deserve the extinction they face.

Many “active” managers, of course, provide neither intelligent risk management nor meaningful relationships. Like the dodo, they’re mostly praying that no one notices and, unlike the dodo, they mostly deserve the extinction they face. Shortly after announcing the reorganization, BP Capital shared very sad news with its shareholders, that portfolio manager “Anthony Riley, CFA, unexpectedly and tragically passed away on Saturday, July 21, 2018. The BP Capital TwinLine team is extremely saddened by the news, but is grateful for Anthony’s hard work and contributions, and he will be greatly missed.” We extend our sympathies to Mr. Riley’s family and the folks at BPC, and wish them great peace.

Shortly after announcing the reorganization, BP Capital shared very sad news with its shareholders, that portfolio manager “Anthony Riley, CFA, unexpectedly and tragically passed away on Saturday, July 21, 2018. The BP Capital TwinLine team is extremely saddened by the news, but is grateful for Anthony’s hard work and contributions, and he will be greatly missed.” We extend our sympathies to Mr. Riley’s family and the folks at BPC, and wish them great peace.

Roughly contemporaneous with the ending of the Morningstar Conference this year was an announcement in the Chicago media that “billionaire” Joe Mansueto, through his newly formed real estate group Mansueto Properties, was purchasing the Wrigley Building in Chicago for a reported $255M. In 2011 you could have bought the building and an adjacent parking garage for $33M. The parking garage was subsequently sold separately for $42M in 2014. This proves two things: (a) in real estate investing, timing and location are everything and (b) better financially to have been the founder and principal original shareholder of Morningstar as a public company, all other things being equal, than a Morningstar subscriber.

Roughly contemporaneous with the ending of the Morningstar Conference this year was an announcement in the Chicago media that “billionaire” Joe Mansueto, through his newly formed real estate group Mansueto Properties, was purchasing the Wrigley Building in Chicago for a reported $255M. In 2011 you could have bought the building and an adjacent parking garage for $33M. The parking garage was subsequently sold separately for $42M in 2014. This proves two things: (a) in real estate investing, timing and location are everything and (b) better financially to have been the founder and principal original shareholder of Morningstar as a public company, all other things being equal, than a Morningstar subscriber.

The Ritholtz Empire grows

The Ritholtz Empire grows

I commend to you all a talk given by Steven Bregman of Horizon Kinetics entitled “

I commend to you all a talk given by Steven Bregman of Horizon Kinetics entitled “