It’s May.

Welcome to the Mutual Fund Observer’s ninth anniversary edition. When we first launched in 2011, Chip cautiously observed that the average independent website had a six-week lifespan and a median visitor of … one.

We appear to have beaten the averages by 462 weeks and 1,812,027 readers.

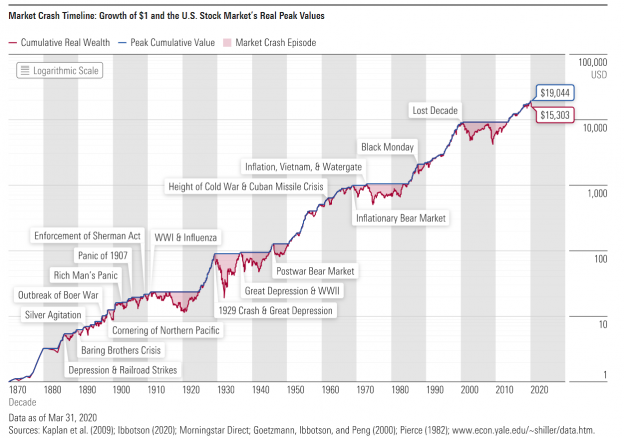

Our decade of readership looks remarkably like the rhythm Continue reading →

Matthew Kenigsberg, Vice President of Investment & Tax Solutions at Fidelity Investments, summarizes the benefits of managing the impact of taxes on investments well in “

Matthew Kenigsberg, Vice President of Investment & Tax Solutions at Fidelity Investments, summarizes the benefits of managing the impact of taxes on investments well in “