It’s May.

Welcome to the Mutual Fund Observer’s ninth anniversary edition. When we first launched in 2011, Chip cautiously observed that the average independent website had a six-week lifespan and a median visitor of … one.

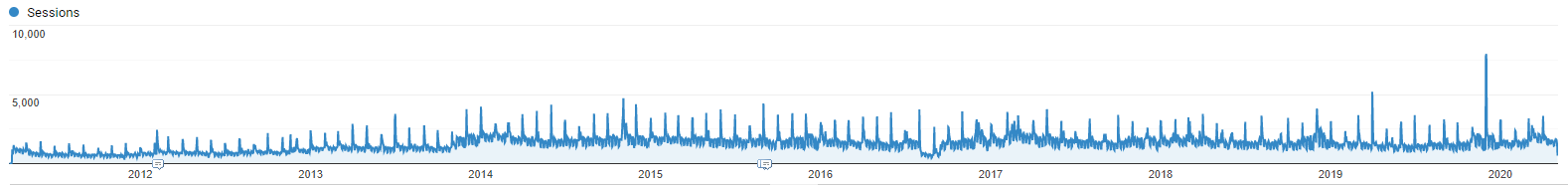

We appear to have beaten the averages by 462 weeks and 1,812,027 readers.

Our decade of readership looks remarkably like the rhythm on a heart monitor:

For that, thank you, dear friends. You are the beating heart of this community. You keep it going and, you alone, keep it meaningful.

Thank you.

I’m always at pains to thank the folks whose financial support keeps the lights on. Gregory, William, Matthew, the other William, Brian, David, and Doug have made small, regular contributions. Paul from New Paltz (a community that Chip, a former SUNY CIO, celebrates as home to her niece Cady’s university), Parker, R.W., Mitchell, and Wilson, too, weighed in this month and we’re in your debt.

I less regularly acknowledge the importance of the notes you’ve shared, sometimes a hand-written assurance that we’ve helped make retirement a bit more manageable or an emailed quip, that we read and share and read again. Thank you for them.

And thanks to my colleagues, remarkable people, who with little expectation of fame or fortune, share huge slices of time and formidable skills to make this all possible To Ed and Chip, Charles and Lynn, Bob C and David W, thanks.

The year ahead promises to be challenging. Have faith and work for the good. We’ll be here for you, and we’ll try to do likewise.

– – – – –

Things I think I think

That it’s always risky to ask smart, quiet people, “what are you thinking?” The Latin proverb is “altissima quaeque flumina minimo sono labi” … the deepest rivers flow with the least sound.

It’s the flip side of the observation attributed to Plato, “An empty vessel makes the loudest sound, so they that have the least wit are the greatest babblers.”

This month I asked my colleagues that very question: what are you thinking? I asked because they’re very good, and very different one from the other. I’m delighted to share their answers in a series of short essays this month, each entitled “What I’m thinking.” Their answers are very different, uniformly provocative, and intermittently optimistic. “Decisive action by the grown-ups may have allowed us to dodge both a depression and mass death, but the cost has been high, is climbing, and must be borne.” I commend their disparate reflections to you.

And me?

I think that Wall Street isn’t Main Street, and I think that Main Street is vastly more important. Wall Street is an important game, played primarily by people vastly wealthier than us, primarily for the benefit of people vastly wealthier than us, but with serious consequences for us.

That said, we live in towns, not in spreadsheets. Those towns need us. We need to support their vitality now if we expect to have them there for us and for the generation beyond. There’s a lot you can do to make that happen.

We have re-subscribed to the local newspaper online, the Quad City Times, to support the professional reporting we need to make sense of our world. Many papers have been pushed to the brink of extinction as ad revenues have collapsed. National outlets – the New York Times, Financial Times, Wall Street Journal, National Public Radio, and Marketplace – do outstanding work helping us understand the world and we support them all. Local media, more quietly, keeps alive a sense of community and a connection to the lives and needs of those we see each day.

We have established a rhythm of ordering food-to-go for one dinner in three, then over-tipping. Mostly mom ‘n’ pop restaurants which are driven by a family’s passion and are vital to the lives of dozens though not hundreds: Café de Marie, Azteca, Nally’s Kitchen, Steel Plow … It’s a nice break from the healthy dinners I’ve been inflicting on Chip and my son, Will.

We’re shopping locally, online, a lot. Our default has been gift cards, that provide a bit of cash flow for the business owners now … and a bit of beer, wine, chocolate, gifts, and dinners for us in the months ahead.

We’ve donated our stimulus checks to people who can use the money more effectively than we can: my particular check got split between the RiverBend Food Bank ($500), the Quad Cities Disaster Recovery Fund to support local businesses and service organizations in need ($500) and … well, Joe Biden ($200) because we really need a return of grown-ups and I was really irked that the Treasury insisted on sending me a written reminder of the source of this largesse:

I considered it part of my effort to get to “stronger than ever before” thing.

We’ve contributed to meet matching gifts and challenge grants from rich folks who are trying to make the most difference. Murry Gerber offered up to a $1 million match for folks who help Augustana weather the storm; I shared $500. A coalition of local businesses offered a $150,000 match for United Quad Cities for COVID-19 Recovery,” which supports the Quad Cities Disaster Recovery Fund; I shared $250 separate from the stimulus check and the Fund has provided over $1 million in direct support for small businesses. Bill Gates matched Donors Choose contributions that supported the transition to remote learning during the crisis; I made him ante up. None of my gifts were major, but they worked to make sure we weren’t leaving money on the table.

We’ve planted trees, rather a lot of them, through a small non-profit called One Tree Planted. At the rate of a dollar a tree, they’re attempting to replant damaged and degraded woodlands across the world.

On behalf of a young friend in Boston, my students, and our readers, we’ve planted nearly 500 trees.

Chip and I have enjoyed nighttime walks in which we’ve noticed that the stars shine more brightly now, and seem more numerous. We’ve watched the Squirrel Wars on our deck and celebrated swarms of goldfinches, Iowa’s state bird. Much of the planet, scientists say, breathes easier than it did just three months ago. And yet the global climate crisis ticks on, with ever-better data painting a picture of accelerating change.

Chip and I have enjoyed nighttime walks in which we’ve noticed that the stars shine more brightly now, and seem more numerous. We’ve watched the Squirrel Wars on our deck and celebrated swarms of goldfinches, Iowa’s state bird. Much of the planet, scientists say, breathes easier than it did just three months ago. And yet the global climate crisis ticks on, with ever-better data painting a picture of accelerating change.

Reforestation will help. Pakistan has even enlisted tens of thousands of COVID-idled workers in an effort to help plant billions of trees. With luck, our experience in fighting COVID – both the re-emergent role of science and the greater recognition of our interdependence and vulnerability – will help. And, too, the pressure from the investor community will help. We’ll return in June to our coverage of ESG- and impact investing, one year after we began our discussion of those issues.

And we’ve reached out. The distant family members – in New York and Pennsylvania – who used to hear from us occasionally, now get check-ins weekly. Students who’ve done well get hand-written notes. Neighbors get an extra wave. “Essential” workers get a smile (masked, sorry) and heartfelt words of respect. Folks in the industry get a dose of my, perhaps, annoyingly Midwestern take on sharing.

– – – – –

The Mutual Fund Observer is a singularly optimistic platform. We launched 9 years ago because we thought we could make a difference. We believed, and believe, that small investors can be guided to make better choices and live more secure lives. We believed, and believe, that there are small investment managers who are brilliant and passionate and determinedly out-of-step, and that we might help you discover them. We were optimistic that a site with no commercial backing, no ads, no ready source of attention or revenue, could make a difference.

Odd, since I am not, by nature, an optimist. For any fan of the Pittsburgh Pirates, the past 30 years has pretty much wrung that out of us.

I am, however, rational. Indeed, in a very real way, optimism is rational. Research in a half dozen fields, from management and economics to psychology and genetics, makes a compelling case for rational optimism. The “rational” part of “rational optimism” is the part that recognizes disasters, but also recognizes that disasters are overcome and looks actively for paths through – and beyond – the rubble.

Optimism seems doggedly successful, perhaps because optimism is doggedly adaptive. After controlling for a variety of factors, optimists are significantly more likely to maintain better financial health than others, they’re more resilient in the face of adversity, they make more money, they’re more likely to be promoted … heck, they even live 10% longer than the rest of us. And yet …

Optimism has never been popular. John Stuart Mill, almost 190 years ago, wrote that “I have observed that not the man who hopes when others despair, but the man who despairs when others hope, is admired by a large class of persons as a sage.” Then, as now, pessimism buys attention and attention is intoxicating. It’s the oxygen and the heroin of both new and social media platforms, and of gadflies.

I had cause this month to reread the last words ever written by America’s longest-serving president.

April 13 was Jefferson Day, so declared by Franklin Roosevelt in 1938. Jefferson was born on April 13, 1743. He is, for all the painful ambiguities of his life and legacy, one of the three faces that every national politician dreams of seeing in the mirror in the morning. (Yes, I know, narcissists have a different dream.)

Roosevelt wrote his 1945 Jefferson Day speech on April 12, declared it done, sat for a portrait, and settled into lunch. Before he could eat, he suffered a stroke and collapsed. By day’s end, a presidency that stretched 4423 days had ended. His speech was never delivered but is available to us.

As he wrote it, he could see that light at the end of the tunnel: “The once powerful, malignant Nazi state is crumbling” and the Japanese homeland was being pounded. His attention seemed to be turning to the future, to rallying Americans from the temptation to withdraw in exhaustion and disgust.

We must go on to do all in our power to conquer the doubts and the fears, the ignorance and the greed, which made this horror possible.

Thomas Jefferson, himself a distinguished scientist, once spoke of “the brotherly spirit of Science, which unites into one family all its votaries of whatever grade, and however widely dispersed throughout the different quarters of the globe.”

Today, science has brought all the different quarters of the globe so close together that it is impossible to isolate them one from another.

Today we are faced with the preeminent fact that, if civilization is to survive, we must cultivate the science of human relationships—the ability of all peoples, of all kinds, to live together and work together, in the same world, at peace.

Let me assure you that my hand is the steadier for the work that is to be done, that I move more firmly into the task, knowing that you—millions and millions of you—are joined with me in the resolve to make this work endure.

The work, my friends, is peace. More than an end of this war —an end to the beginnings of all wars. Yes, an end, forever, to this impractical, unrealistic settlement of the differences between governments by the mass killing of peoples.

Today, as we move against the terrible scourge of war—as we go forward toward the greatest contribution that any generation of human beings can make in this world- the contribution of lasting peace, I ask you to keep up your faith. I measure the sound, solid achievement that can be made at this time by the straight edge of your own confidence and your resolve. And to you, and to all Americans who dedicate themselves with us to the making of an abiding peace, I say:

The only limit to our realization of tomorrow will be our doubts of today. Let us move forward with strong and active faith.

Some thoughts can’t be fit in a tweet and yet, 75 years on, remain evergreen. To the scientists. To the helpers. To the grown-ups who aspire to leadership. To the millions and millions who have joined in common resolve.

Thank you.

Be resolute.

We’re together.

There is a strong case to be made that we might soon experience another dramatic downswing in the stock market. Even those defending the split between Main Street (which is seeing record unemployment applications) and Wall Street (which ended April in the grasp of the year’s second bull market) based on the notion that Wall Street is always looking ahead, conclude “If you want to find peace of mind and haven’t sold yet, cashing in some of the gains since March makes sense” (James MacIntosh, “Market’s comeback isn’t really that crazy,” Wall Street Journal, 5/1/2020). Our colleague, Ed Studzinski, argues for moving to substantial levels of cash. Mark Hulbert, market historian, imagines the prospect of a serious challenge in August and JPMorgan putting the prospect of a serious fall at 60%. Neither Jeff Gundlach nor Mohammed El-Erian is sanguine. Mr. Buffett seems to have made no new investments in the stock market during the decline, though he does affirm his long-term faith:

We haven’t forgotten how to make progress in this country. And we haven’t lost interest in making progress. And that will benefit to varying degrees of all kinds of people, I think, around the world, but there will be interruptions. And I don’t know when they will occur. And I don’t know how deep they will occur. I do know they will occur from time to time, but I also know that we’ll come out better on the other end.

Caution seems warranted, dear friends. Not pessimism. Not flight. Caution.

“The American miracle, the American magic has always prevailed and it will do so again.” I concur and I’ll see you in June.